A lot of traders love the IBD style of breakout trading and riding them forever. The honest truth is that this approach is incredibly hard. Even the best I know, including Bill O’Neil’s his right-hand man, hasn’t made money with that style in five years. And that includes both the COVID market and the “straight up” tape of the last two years.

What has worked, and what can make you rich (trade to get rich), is trading higher-timeframe overextensions on mid- to large-cap stocks after they’ve been badly beaten down.

You don’t have to be a genius. You don’t have to time it perfectly. You just have to keep your logical cap on, wait for the handful of unique opportunities each year, and recognize when prices are so attractive you’ll want to hold them for the next couple of years or more.

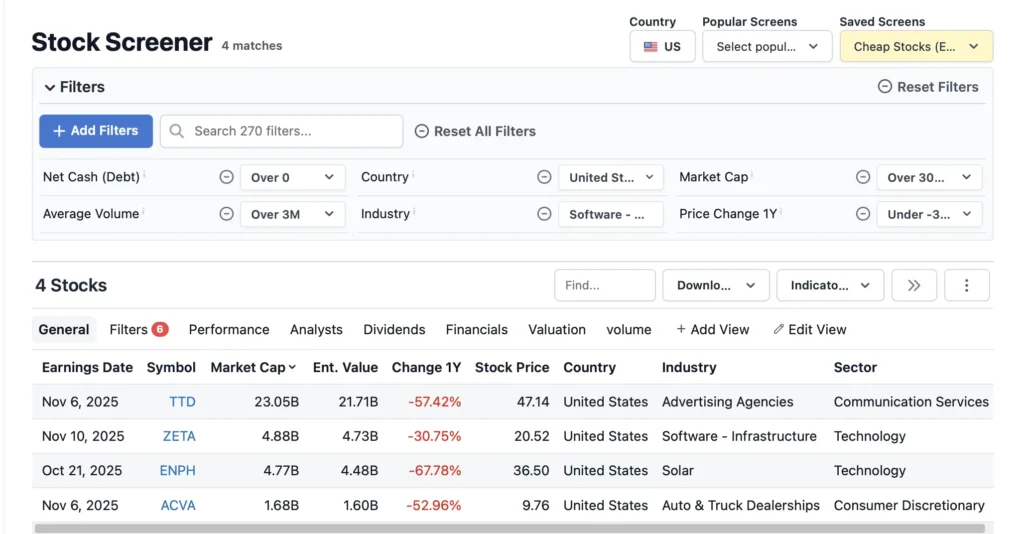

I run a simple screener I call “Cheap Stocks” through Stock Analysis, which costs me $5.91 per month.

The criteria

- Net cash (no debt)

- Average volume greater than 3 million

- U.S. companies only

- Excluded: biotech, banks, shell companies, commodities, capital markets, utilities, real estate, railroads

- Market cap over $300 million

- Down at least 30% in the last year

Right now, it’s only spitting out four names worth paying attention to:

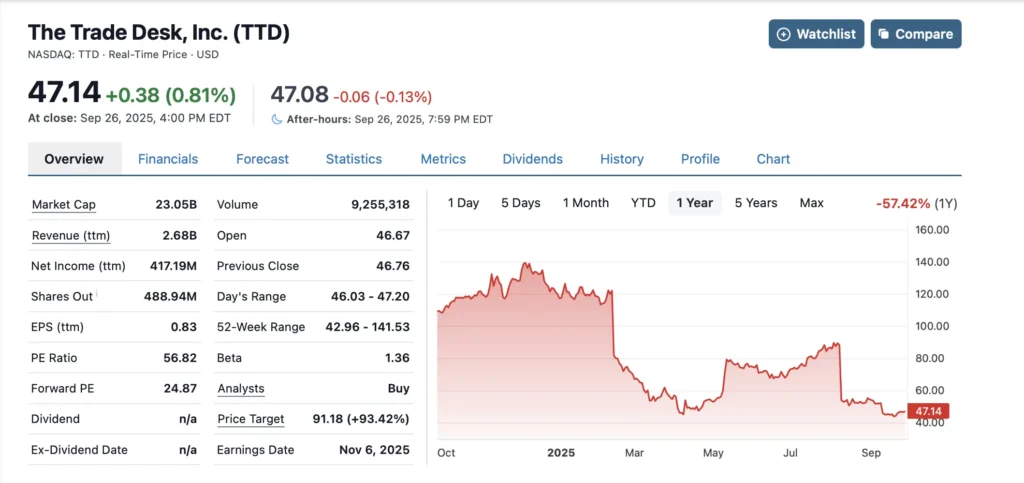

$TTD – The Trade Desk

The leading independent ad-tech platform has been hit by slowing digital ad spend and fears over competition from Google and Amazon.

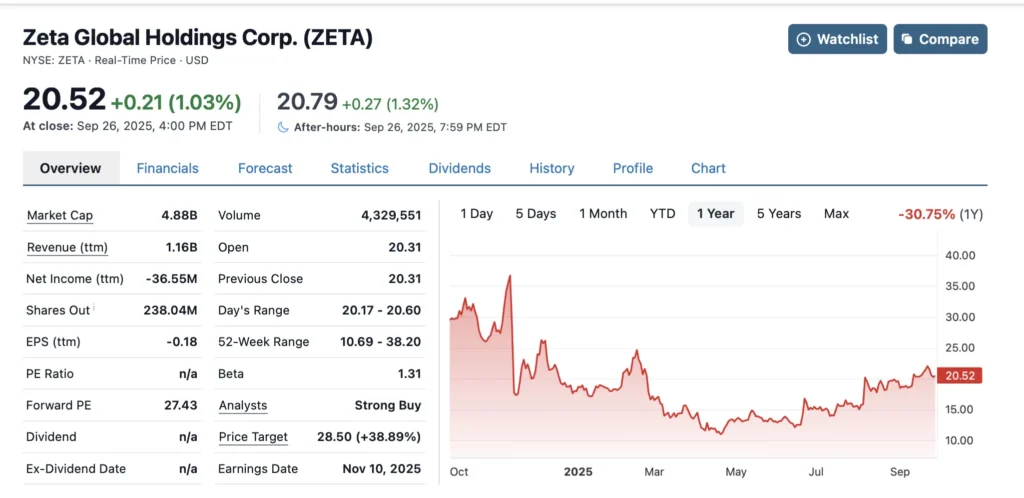

$ZETA – Zeta Global

A marketing automation and AI-driven ad-tech company, crushed by investor concerns about rising costs and skepticism over its ability to scale profitably in a weak ad market.

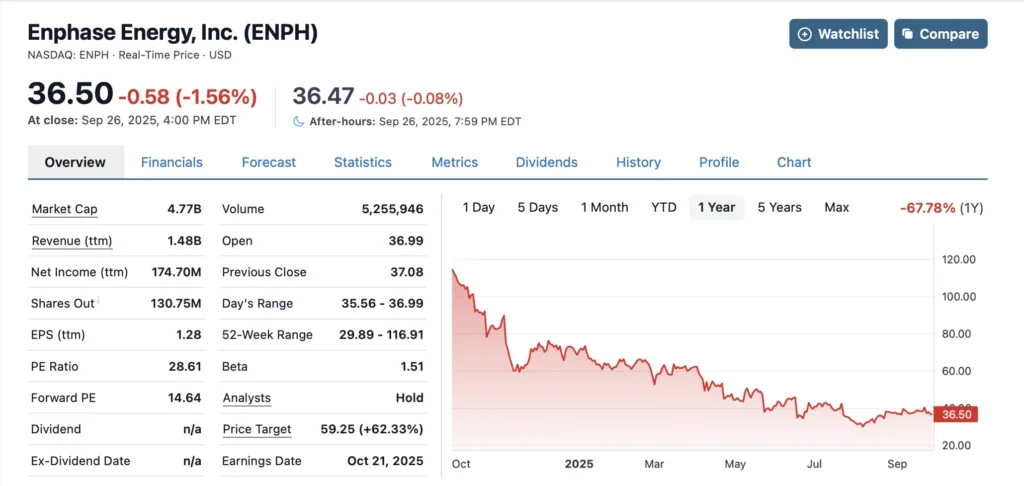

$ENPH – Enphase Energy

The solar inverter leader lost half its value as rising interest rates killed demand for residential solar and high inventory levels pressured margins.

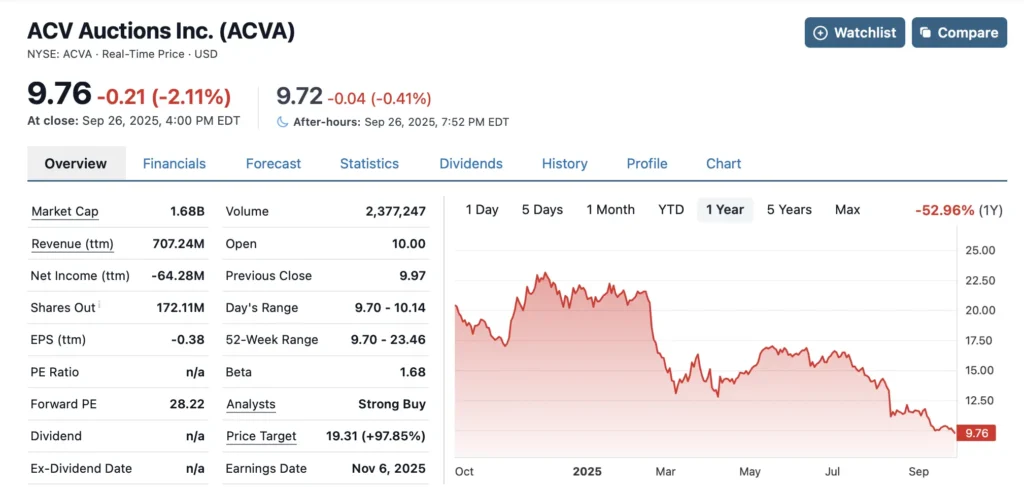

$ACVA – ACV Auctions

The online wholesale auto auction platform has fallen as used-car prices normalized post-pandemic and profitability timelines stretched further out than investors expected.

Use this week to dig into these companies and learn everything you can. That way, if the setup ever lines up for you, you’ll be ready to act with confidence instead of treating it like just another trade.

And, if you haven’t signed up for Stock Analysis, why not? It’s just $5.91/m with discount code SAVEONTRADING. It comes with a 60 day money back guarantee, and I’m pretty sure you’ll love the platform!

Cheers,

Kyle Vallans

Founder, SaveOnTrading