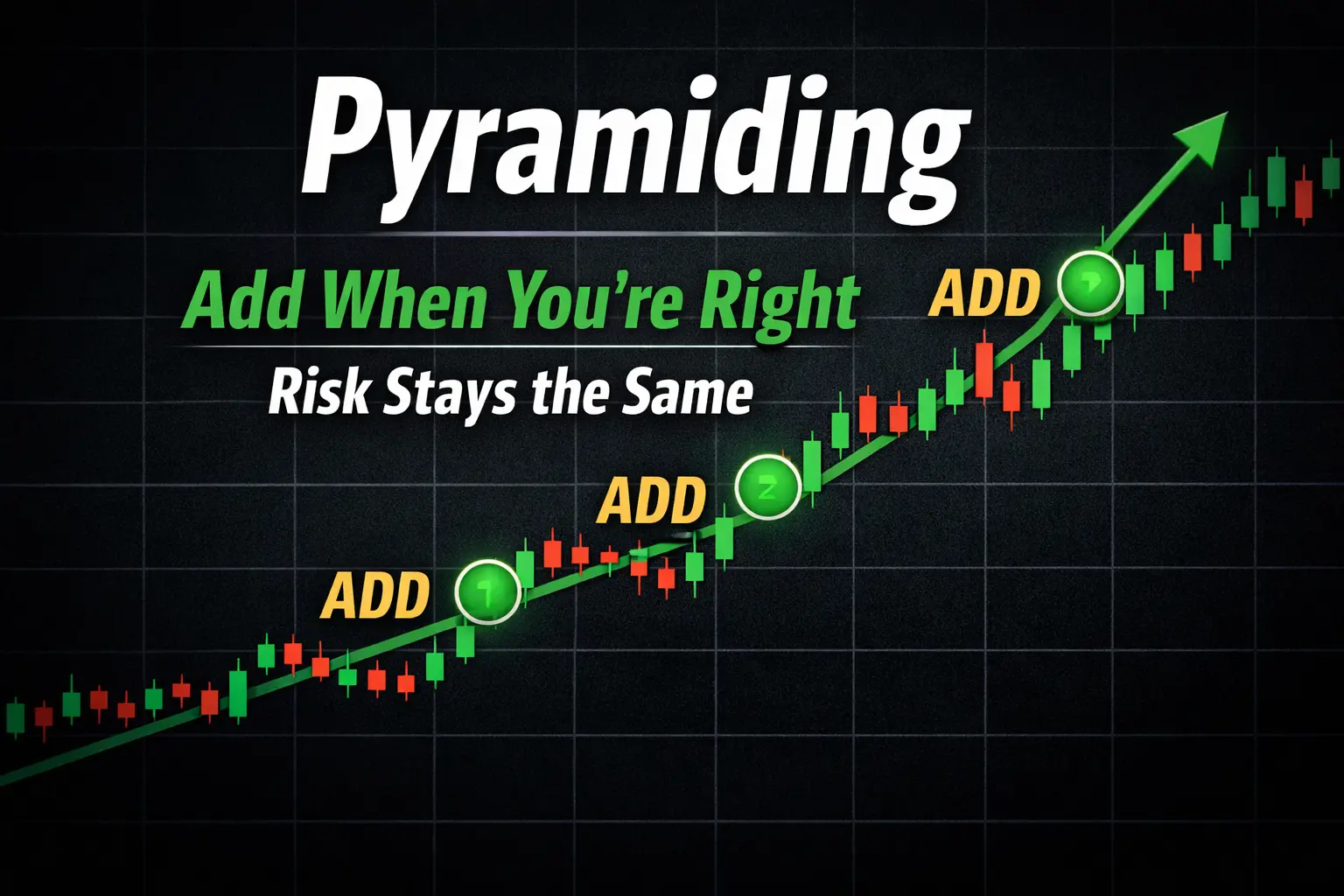

Learn how pyramiding works in trading. Add to winning positions while tightening risk and keeping your original target intact to increase profits.

Is Nextdoor stock undervalued? A deep dive into NXDR’s users, cash position, dilution risk, and why this could be an asymmetric turnaround bet.

Your trading system should be simple enough that someone with no experience could follow it and at least break even. If you cannot clearly explain your edge, your entries, and your risk in a few paragraphs, it is probably too complicated to survive long term.

A personal look at trading with constraints, overnight momentum, higher-time-frame reversals, and why big goals only work with the right life foundations.

How I combined Trade Ideas and Ask Edgar to catch a 293% overnight momentum winner in $BNAI.

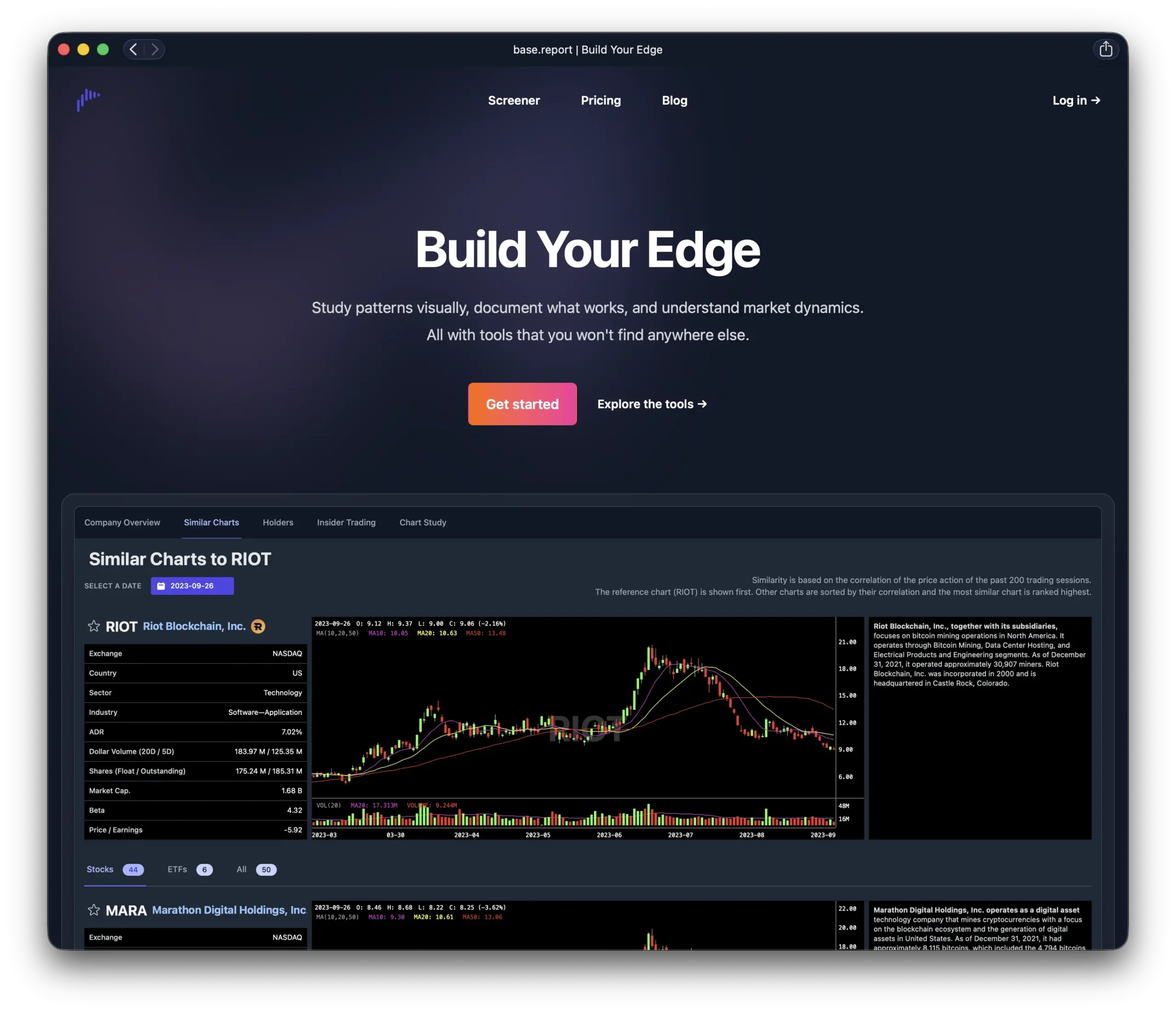

An in-depth founder interview of e0 exploring base.report and its approach to structured market prep for swing traders.

Discover the best trading podcasts featuring real traders sharing their stories, strategies, and lessons learned. Bookmark this master list and listen at your own pace.

Traders don’t fail because their strategy is bad. They fail because they forget the goal. Here’s the hardest lesson I had to learn.

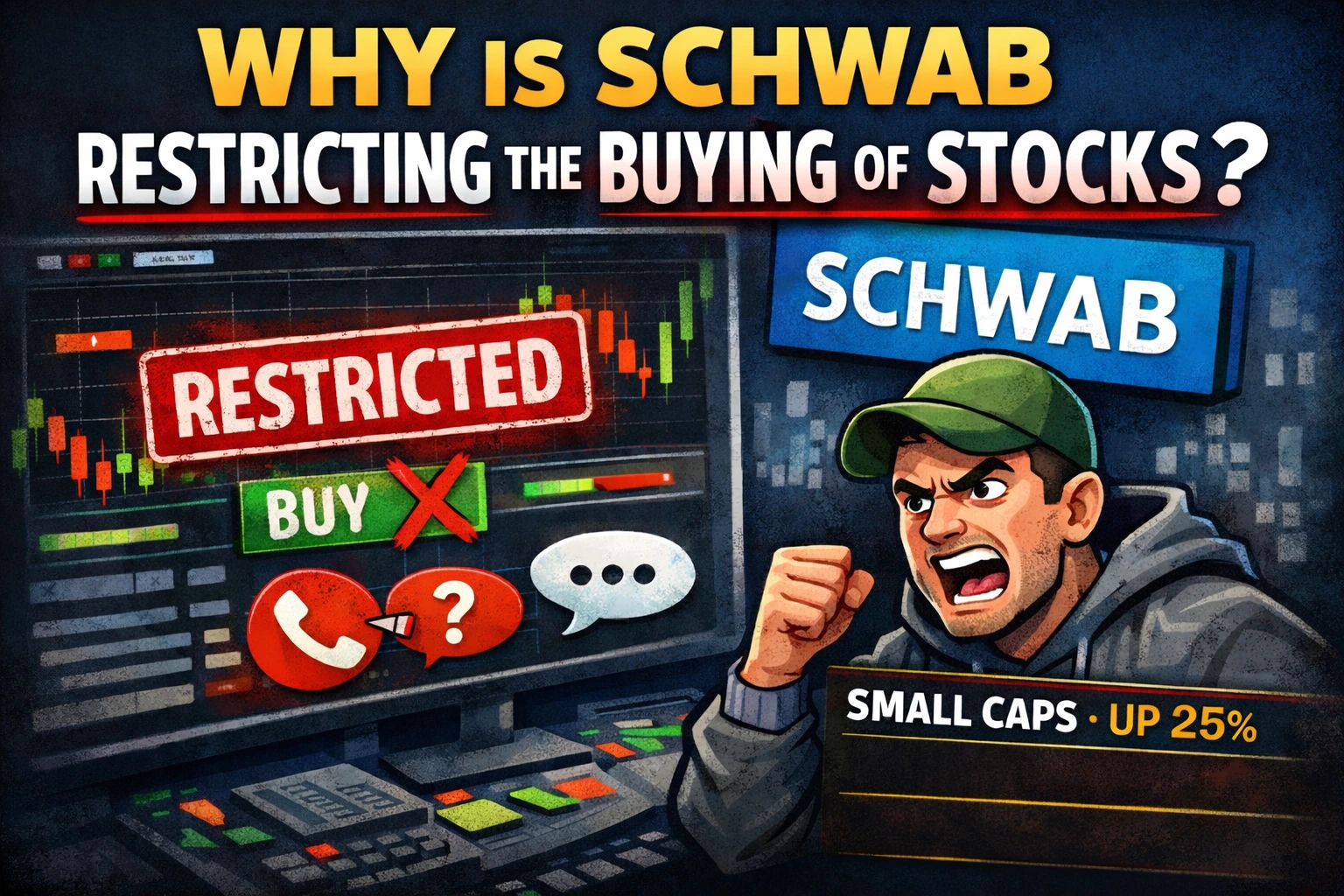

Schwab has aggressively begun restricting the buying of volatile small cap stocks for active traders leaving us with no choice but to move elsewhere.

It has come that time in which I have to get back to tracking my trading, and I am using TradeZella as a way to accomplish that!

Momentum stopped working late in 2025. Here’s how my trading is changing in 2026, with a focus on real companies, strong balance sheets, and downside protection.

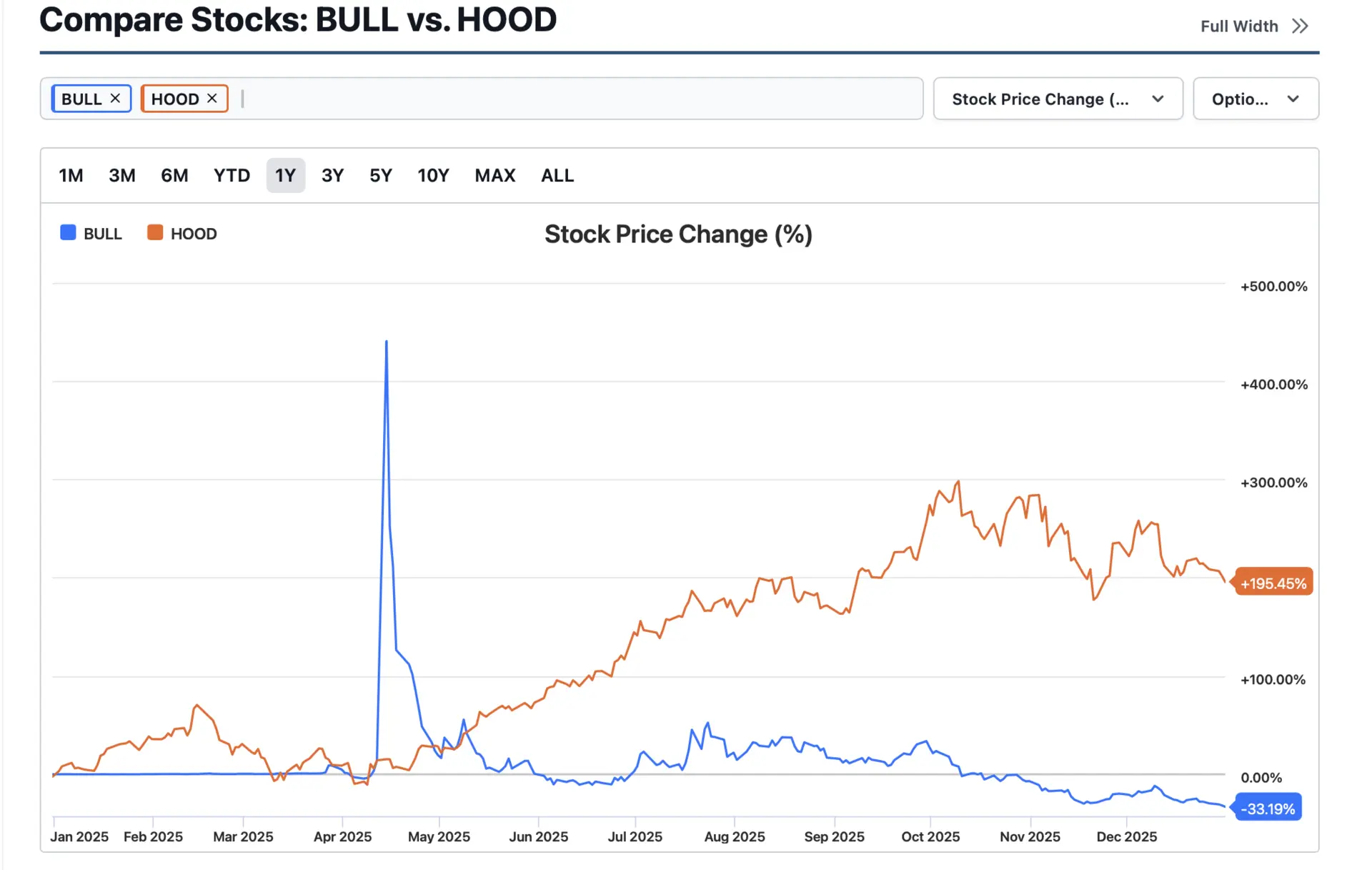

Why I bought $BULL at $7.90 after a week of research, including valuation, cash balance, user growth, and asymmetric upside.

An in-depth founder interview with Dan Mirkin on building Trade Ideas by solving his own trading problems with speed and real-time data.

The Trade Desk is down nearly 70% from its highs, but the business is still growing revenue, has a strong balance sheet, and serves many of the world’s largest advertisers. Here’s why I started a long position in TTD and how I’m thinking about the setup from a higher time frame perspective.

Trading doesn’t have to be flashy to be profitable. By avoiding a few high-risk traps like penny stocks, leverage, leveraged ETFs, and options, traders can dramatically improve their odds and set themselves up for asymmetric returns over time.

iRobot ($IRBT) is heading into OTC trading after a Nasdaq delisting, but that doesn’t change the outcome for shareholders. Here’s what traders need to understand before Monday to avoid unnecessary risk.

Most “best trading books” lists are recycled opinions. This one is different. Using a popular X thread, traders’ recommendations were counted, cleaned, and ranked by frequency to reveal what traders actually recommend today.

PetMed Express ($PETS) caught my attention after a non-binding $4 buyout offer highlighted just how cash-rich the company is. Here’s why I’m long and how I’m thinking about the risk-reward.

Most new traders spend their first couple of years sticking forks into electrical sockets. You learn the hard way, you get burned, and you slowly figure out what actually works. That is the tuition you pay before you have any shot at becoming consistently profitable.

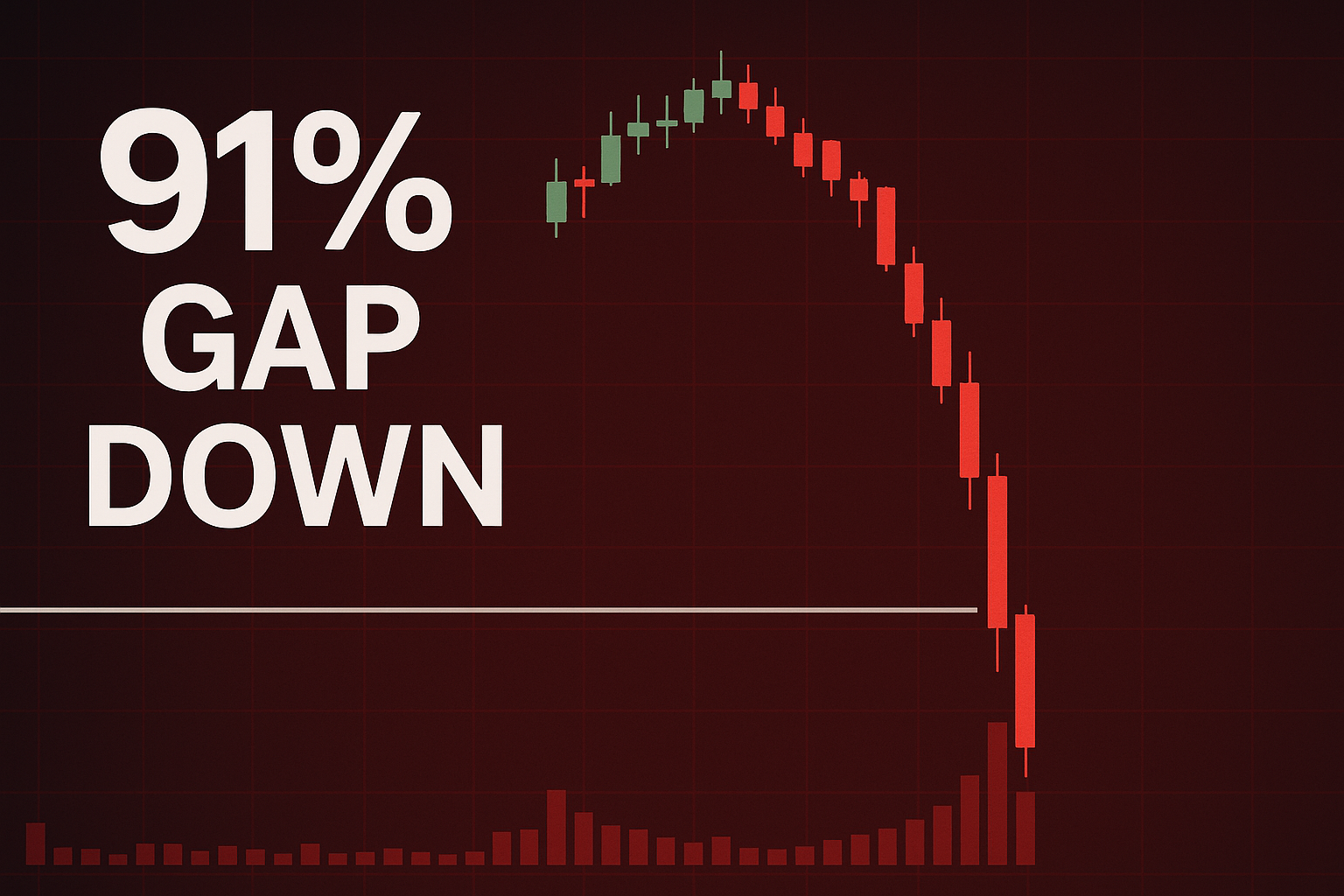

On December 10th I took a long trade on CHOW after it opened 91 percent lower from a limit-down halt. The tape firmed up, buyers stepped in, and I flipped it for a quick gain. Here is exactly how I thought through it and why these small-cap liquidator trades still offer opportunity if you know what to look for.