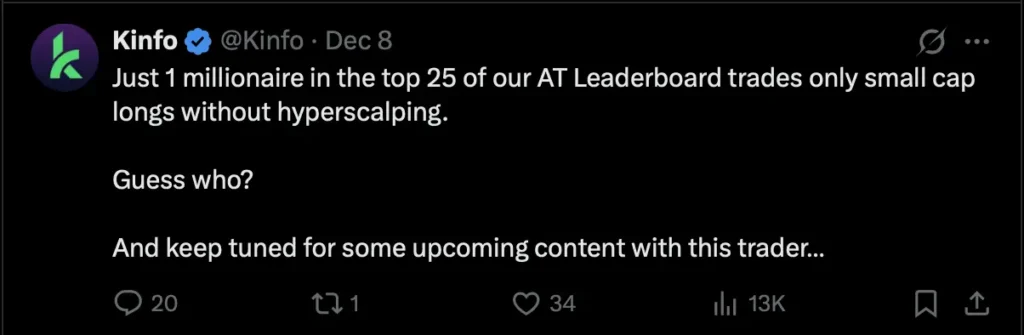

I saw something on Kinfo’s Twitter the other day that pretty much explains why most people lose trading small caps on the long side. Out of their entire top 25 leaderboard, only one small-cap long trader got there without hyperscalping.

The core issue is simple: people forget what they’re actually buying. Every day, they see the 100 percent runners, the 300 percent squeezes, the occasional 1,000 percent intraday move, and they convince themselves they’re going to catch the next one. But buying and holding small caps on the long side almost never works. These companies are almost always garbage. They are serial diluters filled with debt, failed products, and the single mission of extracting as much money out of shareholders as possible, often to line their own pockets. They trade way above their real mean because news hit, or something random happened that day and volume rushed in.

I trade this stuff almost every day. Overnight momentum on small caps is one of my core strategies, and even I have to remind myself that I am not buying a great company at a great price. I am buying a terrible company with temporary momentum. And that is fine as long as it is treated that way.

Here is the part most traders will not admit: the big move everyone dreams about almost always comes from luck, not brilliance. Every outsized win I have had in small caps came from one of three things. Either the stock gaps up huge overnight while I am already in it. Or it halts up intraday and momentum snowballs. Or random news hits the tape and I simply luck out because I am involved. That is it. You do not engineer these moves. They happen to you while you are already positioned. Trying to hold for the big one is exactly how people blow up perfectly good trades. Do this a handful of times over a few months on small caps, and you bleed out double digit percentages until your account has dwindled.

A strong small cap you buy overnight will usually be an okay trade depending on volume, the story, where it closed, the market environment, and the offering risk. You make a little or you lose a little if you are quick and not greedy. The damage happens when someone decides, “I am going to hold this for the big move.” Then it turns. Then it fails the level you thought should really hold. Volume dries up. And suddenly you are sitting in a stock that is headed straight back to its mean, which is almost always way lower than your entry.

And this is the part newer traders hate. If a small cap starts drifting against you, you have to get out. Quickly. These names do not trend. They do not grind higher. They do not come back. They revert, and they revert aggressively.

Once you accept that, the whole game simplifies. Take the liquidity when it is there. Do not stay too long. Do not hold and hope. You are trading momentum in terrible companies. Treat them like terrible companies. That is the difference between surviving and thriving in this niche versus ending up as another blown up small cap long who never figured out what they were actually buying.

It is not easy and it is a tough game to play, but there is money to extract.

Cheers,

Kyle

Founder | SaveOnTrading

PS: The quickest way I gauge a company’s health is by checking the statistics tab on StockAnalysis.com and using Ask Edgar to review filings and offering risk.