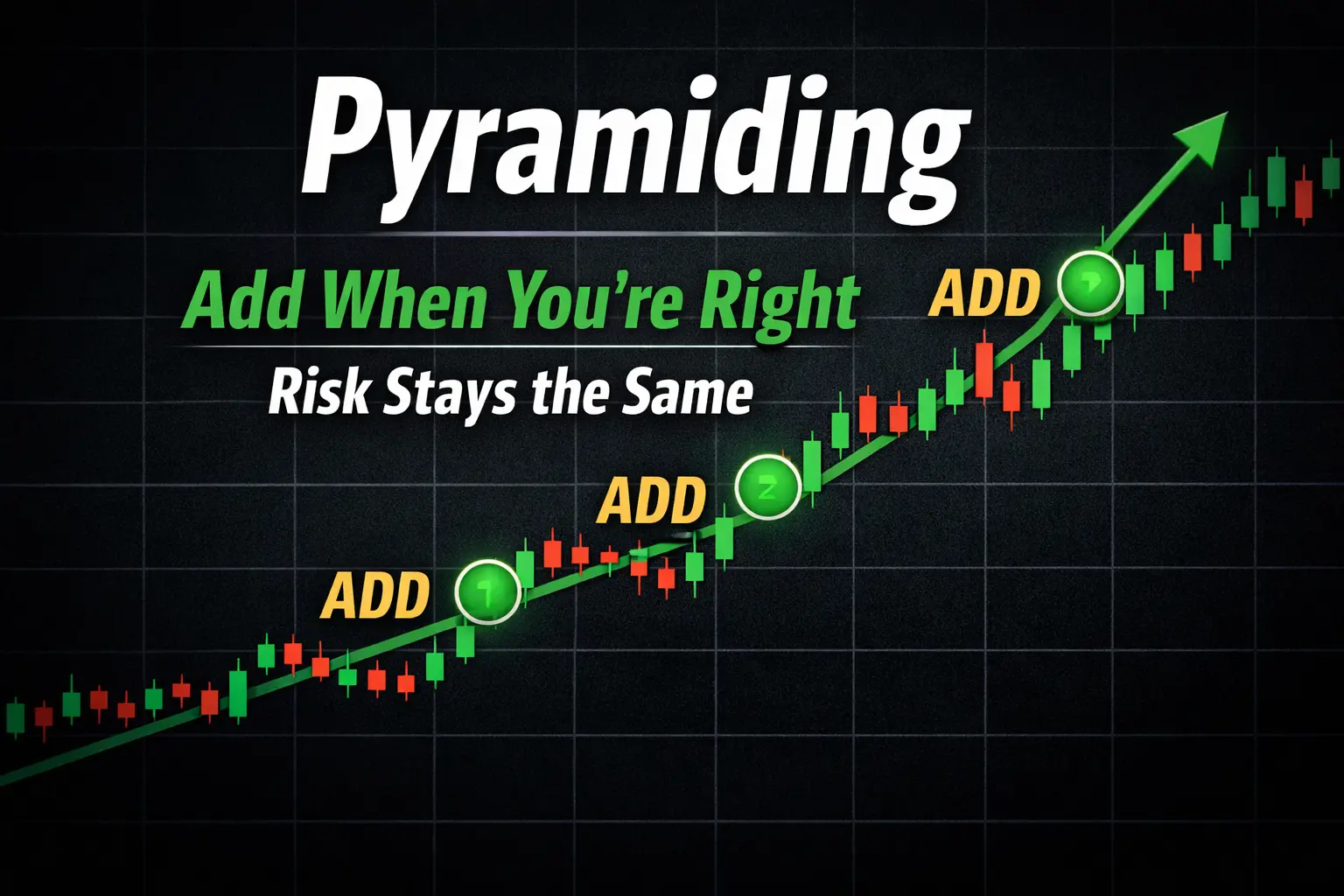

The “big Twitter boys” call it pyramiding.

But what actually is it?

Pyramiding is simple. And it should be used.

Think of it as adding and tightening while still keeping the original target in mind.

Here is a clean example.

You are risking $100.

You buy a stock at 2.00 with a stop at 1.60.

You think it can go to 3.50.

That is 40 cents of risk.

So you take 250 shares.

If the stock goes to 3.50 and you sell, you make:

1.50 x 250 shares = $375.

Pretty straightforward.

Now let’s say the trade starts working.

Instead of using the prior day low at 1.60, you realize something.

If it gets under today’s low at 1.80, the idea is probably shot.

The stock is trading at 2.10.

Now you have options.

Option one.

You keep the 250 shares and just move your stop from 1.60 up to 1.80.

Now instead of risking $100, you are risking about $50.

You tightened up.

You reduced risk.

You did not add size.

That is completely fine.

Option two.

You believe the trade is still intact and actually looks even better now.

So instead of just tightening, you add.

Because your stop is now 1.80, your risk per share is smaller.

That allows you to increase share size while still keeping total risk at $100.

Now instead of 250 shares, maybe you have 400 shares total with an average cost around 2.05.

Your risk is still around $100.

But if the stock runs to 3.50?

Now you make about $580 instead of $375.

Same idea.

Same initial thesis.

Same defined risk ($100)

Bigger reward.

That is pyramiding.

It is not randomly doubling down.

It is pressing a winning trade after it proves itself, while tightening risk.

Sometimes you should just move your stop up without adding.

Other times, when the structure improves and the setup still looks clean, you should pyramid and make it count.

If you are going to be aggressive, be aggressive when you are right.

That is the entire point.

–

P.S. Every consistently profitable trader journals.

If you are serious about improving, tracking your trades is not optional.

Through Save On Trading’s exclusive partnership, you can get TradeZella, the top trading journal, for 20% off using code SAVEONTRADING.

If you plan on pyramiding correctly and pressing your winners, you need the data to know what is actually working.

One solid trade pays for the software.