Get 25% off Ask Edgar with our exclusive discount code below. Works site wide on all plans and is the best offer available.

AskEdgar is an AI-powered research platform that makes it easy to analyze SEC filings, earnings transcripts, and market data. Instead of manually reading through hundreds of pages, traders and investors can ask plain-English questions and get instant, sourced answers saving time and surfacing key insights faster.

Over 2,000 traders rely on AskEdgar to process thousands of filings and uncover information that gives them an edge. Whether you’re scanning for dilution risk, tracking shelf registrations, or digging into a 10-K, AskEdgar helps you make better trading decisions in less time.

Key Features

Nope. AskEdgar breaks everything down for you and answers your questions like a financial research assistant.

It reads filings, identifies relevant details, and generates plain-English responses each linked to the original source so you can double-check.

While traders love it, AskEdgar is useful for investors, analysts, and anyone doing due diligence on public companies.

Yes. AskEdgar processes filings for most U.S.-listed public companies, especially small- and mid-cap stocks where information edge matters most.

Yes. Pro and enterprise users can get full API access for custom workflows or integrations.

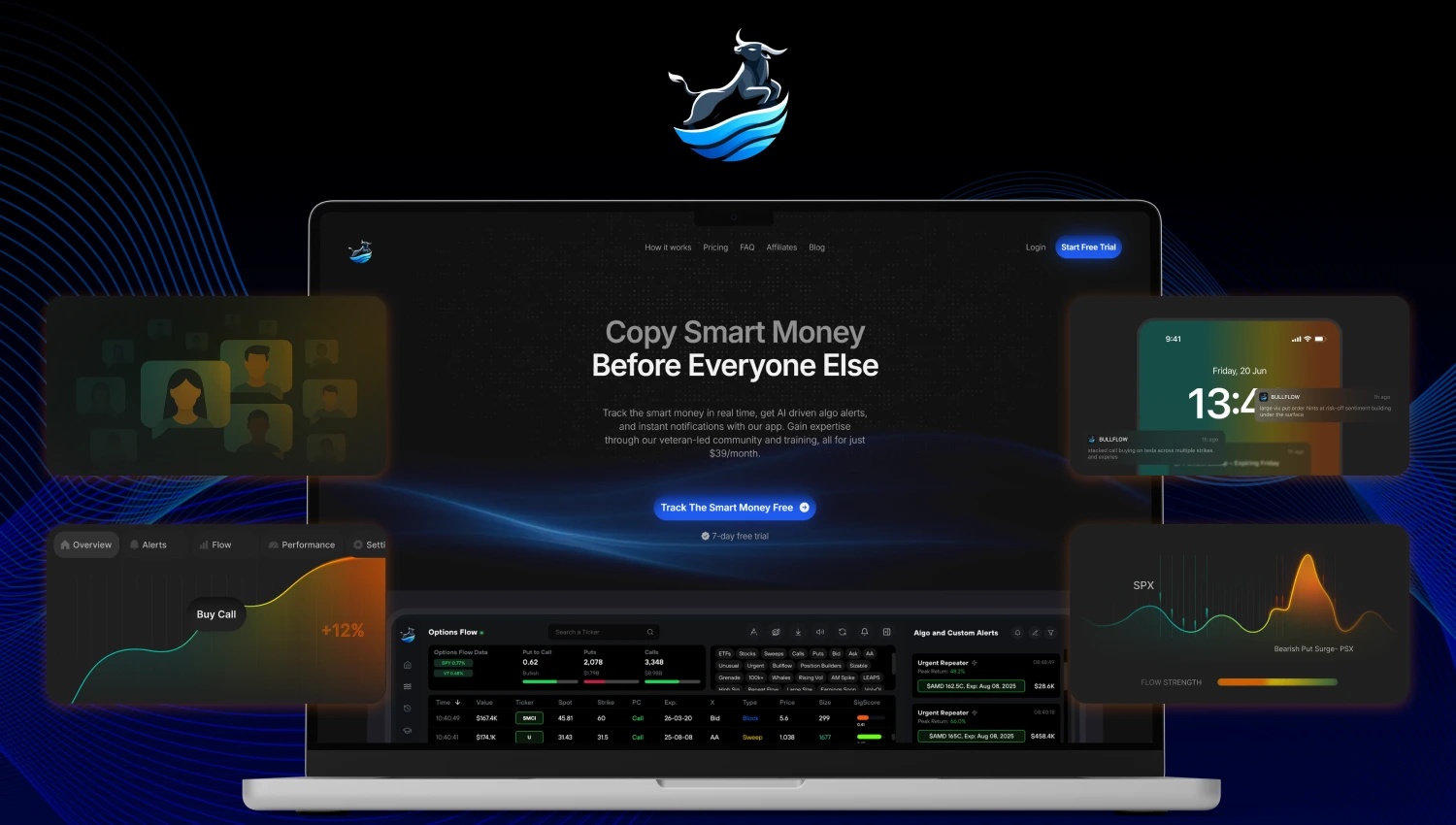

Bullflow.io is a real-time options flow and market data platform that helps traders track institutional activity, unusual options trades, and sentiment to uncover high-probability trading opportunities.

ChartMill is a powerful, web-based stock analysis platform that brings together both fundamental and technical screening tools.

Freedom is a cross-platform app and website blocker that helps users eliminate digital distractions by allowing them to block specific websites, apps, or even the entire internet across multiple devices.

Track and analyze stock dilution events and their impact on share value.

Comprehensive financial terminal with real-time data, advanced charting, and institutional-grade research tools.