In the world of overnight momentum trading, the synergy between Trade Ideas and Ask Edgar is indispensable.

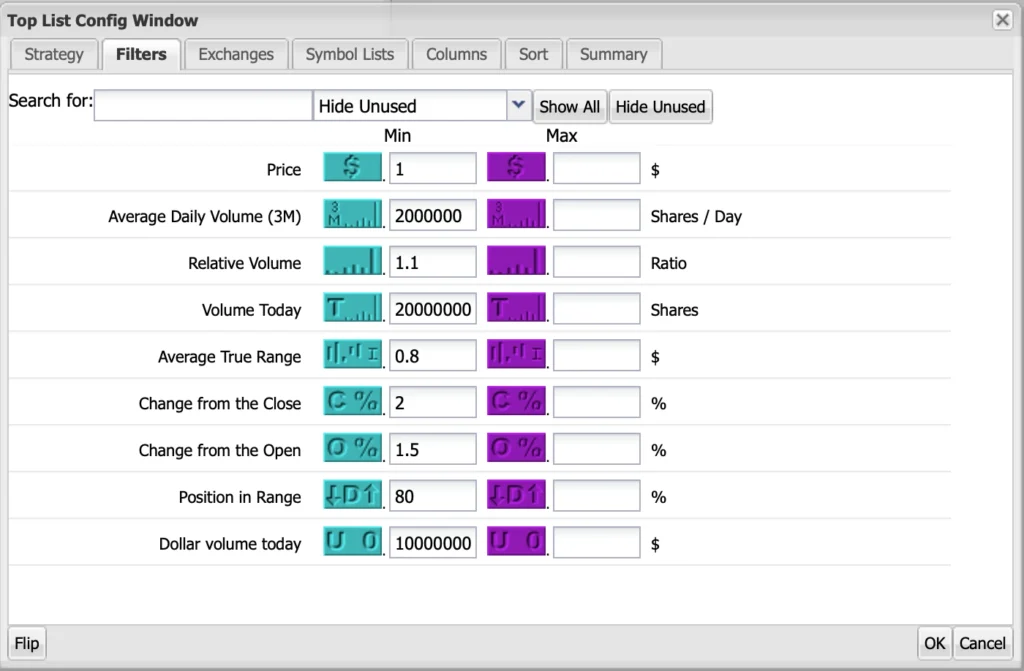

Trade Ideas allows me to filter down to exactly the names I want to see whereas Ask Edgar allows me to determine the overnight risk of each.

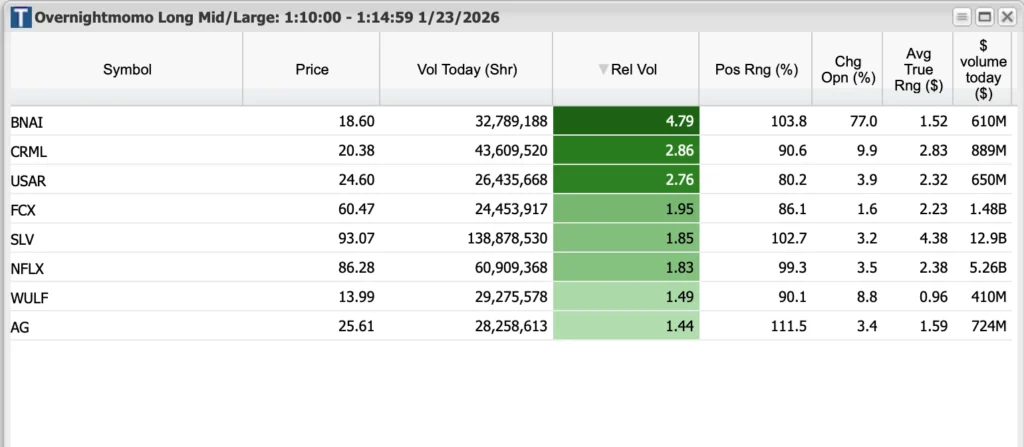

To illustrate, consider a trade I took on January 23rd, 2026, involving $BNAI, a stock that had been gaining attention since December.

The stock set up on my overnight momentum filter just after the close, climbing back into the top 20% of its intraday range on volume.

I’m familiar with $BNAI, but I still needed to check it out before buying it for an after-hours move and potential overnight.

What it had going for it was:

- Incredible volume

- Making fresh highs

- In the top 20% of its intraday range

- Former good candidate for this gap style trade

- Incredibly high short float at 40%+

However, before buying it, I needed to swiftly assess a crucial factor…

And that is,

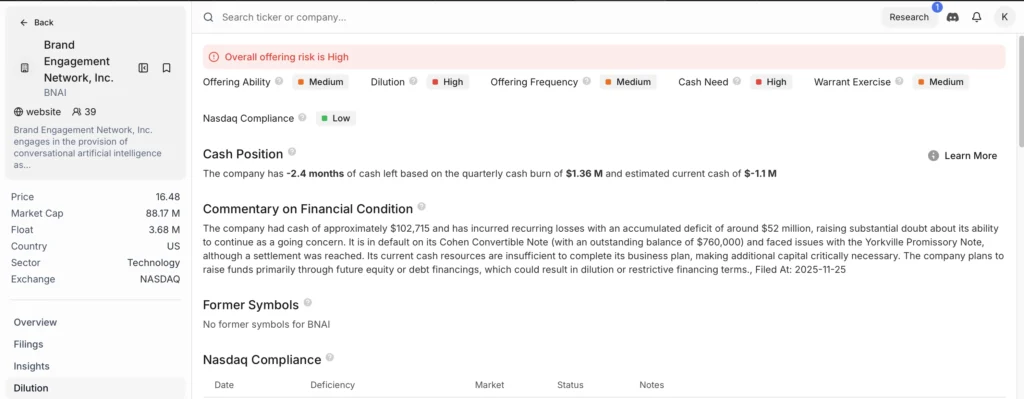

“What is the offering risk”?

For this, I use Ask Edgar 100% of the time.

I don’t have time to dig through all of the filings on my own, and draw conclusions on what the risk is, so I rely on AskEdgar to just tell me with their simple grading system of:

- Low

- Medium

- High

In $BNAI’s case, it was Medium.

But, with so much going for it, I decided it was still worth the risk, but maybe just slightly less risk than something with no offering risk and so I took the trade.

With a stock closing at fresh highs, in the top 20% of its intraday range, and a short float of 40%, it was still a good candidate for an overnight trade.

So, I simply bought it in after hours at 16.72 and was giving it to just under vwap around 14.50 which is how I typically think through risk.

To me, a couple dollars of risk with so much going for it and having a vision of $100+, the asymmetry even with “medium” style offering risk just made sense.

And, I know what you are thinking…

You bought it at 16.72 thinking it had potential of $100?

And, the answer is yes!

I have traded this overnight momentum strategy for now a little over 5 years and have learned the ins and out of just about every permutation.

I have a vision for the one’s that really stick out and in this case, with so much going for it, I thought there was potential of something to really “break” and for it to trade wide-open.

In any event, it sped up so much in after hours, I felt the need to exit the positon at $65.78 and not take it overnight which was the initial plan.

Ultimately, $BNAI exemplified the potential of my overnight momentum strategy, a testament to the hundreds of trades that have honed my approach over the years.

And, without the assistance of Trade Ideas in which I have been able to build my overnight momentum filters into, and the use of AskEdgar in which I can quickly determine the offering risk, I just couldn’t trade this style all that successfully.

If you’re interested, you can get Trade Ideas at 15% off with code SOT15 and Ask Edgar at 25% off with code SAVEONTRADING.

👉 Get 15% Off Trade Ideas With Code SOT15

👉 Get 25% Off Ask Edgar With Code SAVEONTRADING

Cheers,

Kyle

Founder | SaveOnTrading

Not ready yet? Bookmark the Trade Ideas deal and the Ask Edgar deal on SaveOnTrading so it’s there when you are.