Get 25% off Ziggma with our exclusive discount code below. Works site wide on all subscriptions on your first billing cycle and is the best offer available.

Ziggma is a modern portfolio analytics and stock research platform designed to help investors make smarter, data-driven decisions. It combines fundamentals, valuation models, analyst forecasts, and portfolio intelligence into a single dashboard—allowing users to track performance, identify risks, and uncover opportunities with clarity and confidence.

Portfolio Analytics Dashboard

Track performance, diversification, risk exposure, and sector allocation in real time.

Stock Scoring System

Proprietary scores evaluate stocks based on fundamentals, valuation, growth, and momentum.

Intrinsic Value & Valuation Models

Estimate fair value using discounted cash flow and forward-looking assumptions.

Analyst Forecasts & Estimates

View Wall Street price targets, earnings estimates, and analyst sentiment.

Risk & Volatility Metrics

Analyze downside risk, beta, drawdowns, and portfolio volatility.

Watchlists & Alerts

Monitor stocks and receive alerts when fundamentals or valuations change.

Sector & Allocation Insights

Understand how your portfolio is positioned across industries and asset classes.

Clean, Investor-Friendly Interface

Designed to simplify complex financial data without sacrificing depth.

Long-term investors managing diversified portfolios

Fundamental investors focused on valuation and quality

Investors who want clarity on portfolio risk and allocation

Professionals seeking a clean alternative to complex terminals

Portfolio-First Approach – Goes beyond stock picking to portfolio intelligence.

Clear Valuation Insights – Helps investors understand what stocks may be worth.

Time-Saving Research – Consolidates analysis, forecasts, and risk in one place.

Create a Ziggma account and connect or manually add your portfolio.

View portfolio health, risk exposure, and allocation insights.

Research individual stocks using scores, valuation, and analyst forecasts.

Build watchlists and monitor changes over time.

Strong portfolio analytics and risk insights

Clean, intuitive interface

Combines fundamentals, valuation, and forecasts

Ziggma is best suited for long-term and fundamental investors.

No—Ziggma provides data, valuation, and analysis, not direct trade signals.

Yes—portfolios can be connected or manually tracked.

Yes—price targets, earnings estimates, and sentiment are included.

Yes—Ziggma offers a free plan with core features.

Portfolio123 is a professional-grade investment research, screening, and backtesting platform built for traders, portfolio managers, and data-driven investors.

Edgeful is your personal financial analyst, simplifying market data into actionable reports. Instantly see how any stock behaves.

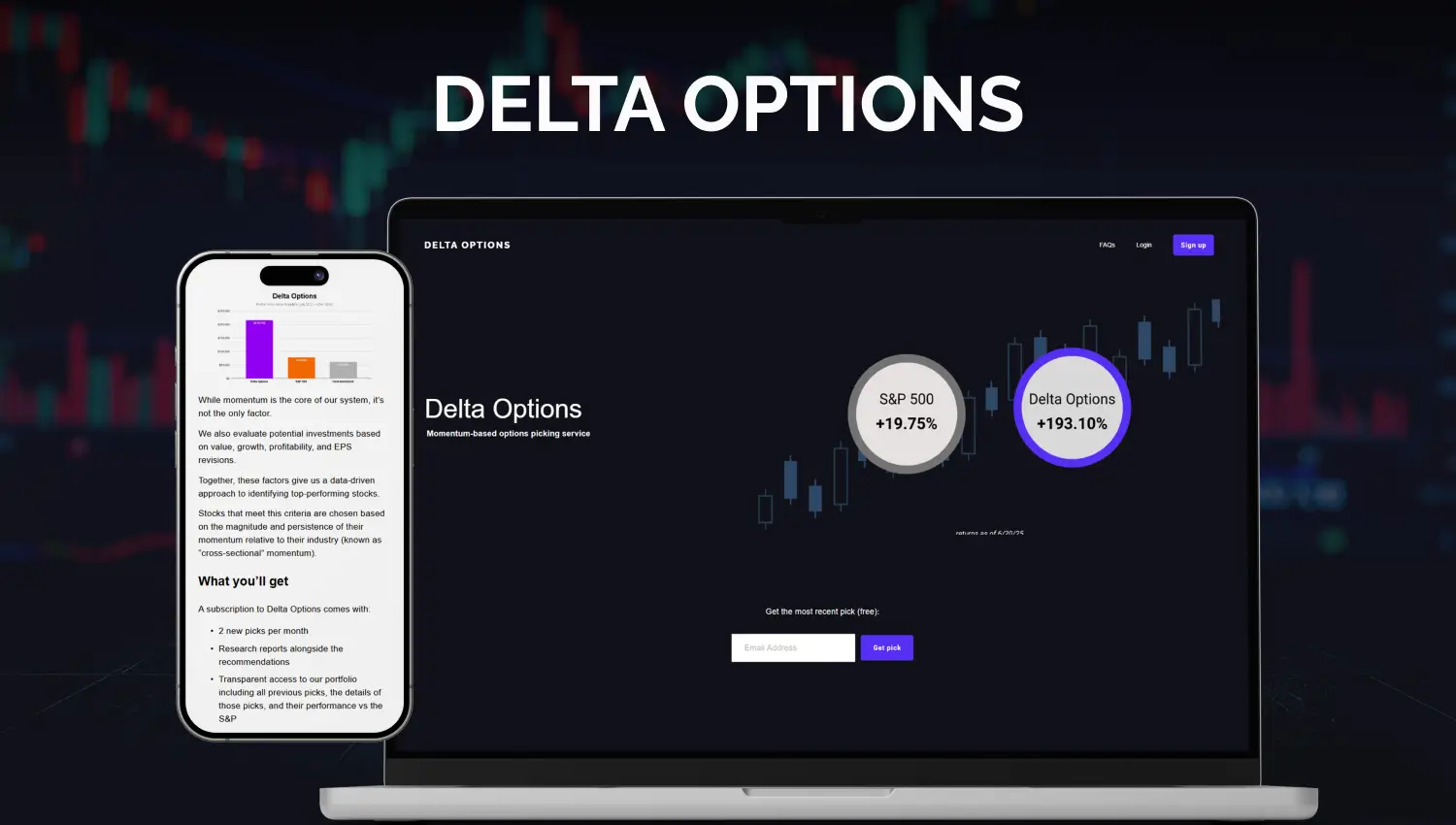

Delta Options is a momentum-driven options trading service delivering two high-conviction picks each month. Since launching in 2022, it has achieved nearly 250% returns with a transparent, data-backed strategy.

Comprehensive stock analysis platform offering statistics, financials, filings, historical data, backtesting, and more.

Track and analyze stock dilution events and their impact on share value.

Comprehensive financial data platform for in-depth fundamental stock research.

No spam. Unsubscribe anytime. Used by professionals worldwide.

We track the best discounts on scanners, screeners, and research tools and email you when they're worth checking out.

No spam. Unsubscribe anytime.