Get 25% off Portfolio123 with our exclusive link - no code needed. Works on your first year for the annual plan and is the best offer available.

Portfolio123 is a professional-grade investment research, screening, and backtesting platform built for traders, portfolio managers, and data-driven investors. It allows users to create custom stock screeners, simulate portfolios, and develop systematic strategies using fundamental and technical factors—all powered by institutional-quality data.

Powerful Stock Screener

Build custom screens using over 10,000 fundamental and technical data points.

Backtesting Engine

Test trading strategies across decades of market history to validate performance and risk.

Portfolio Simulation

Create model portfolios, rebalance rules, and compare performance against benchmarks.

Ranking Systems

Combine multiple metrics into a weighted scoring system to identify high-quality stocks.

ETF & Factor Data

Access advanced factor analytics, macro indicators, and ETF-level analysis.

Custom Formulas

Use formula-based logic to create your own metrics and trading conditions.

Real-Time Data & Alerts

Get live price updates, watchlist tracking, and rebalancing notifications.

Community & Shared Strategies

Explore community-built screens and share your own trading models with others.

Quantitative traders developing systematic strategies

Fundamental investors testing factor-based models

Portfolio managers optimizing diversification and returns

Advanced retail investors seeking institutional-grade tools

Unmatched Flexibility – Full control to build, test, and execute any trading model.

Institutional-Grade Data – Reliable fundamental and market data for robust research.

All-in-One Workflow – Screen, backtest, simulate, and execute—all in one platform.

Create an account and log in to Portfolio123.

Build a custom screener or ranking system using your preferred metrics.

Run backtests to analyze performance and drawdowns.

Convert results into a live or simulated portfolio with automated rebalancing.

Deep backtesting capabilities with customizable metrics

Combines fundamentals, technicals, and factors seamlessly

Ideal for quant and data-driven investors

Primarily U.S. equities, with growing support for global data sets.

Yes—use the built-in formula language to define custom factors and metrics.

Yes—backtesting is included in Portfolio123.

Yes—real-time and end-of-day data are both available depending on plan.

It’s best suited for intermediate to advanced investors comfortable with data-driven analysis.

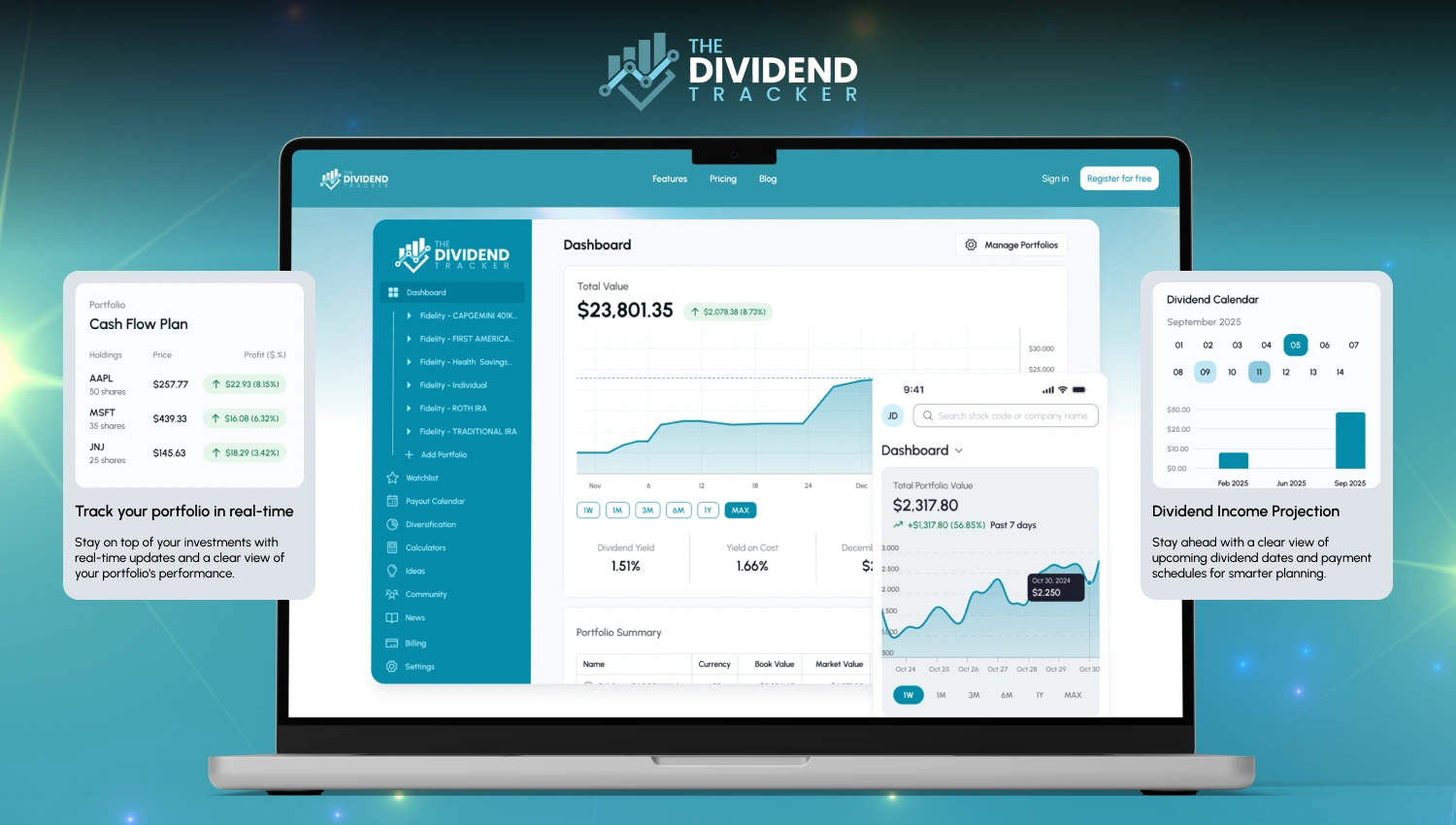

The Dividend Tracker is a portfolio management platform built specifically for dividend investors who want to monitor income, plan cash flow, and track long-term progress with clarity.

MarketDash is a modern stock research and analysis platform built for investors who want both simplicity and depth.

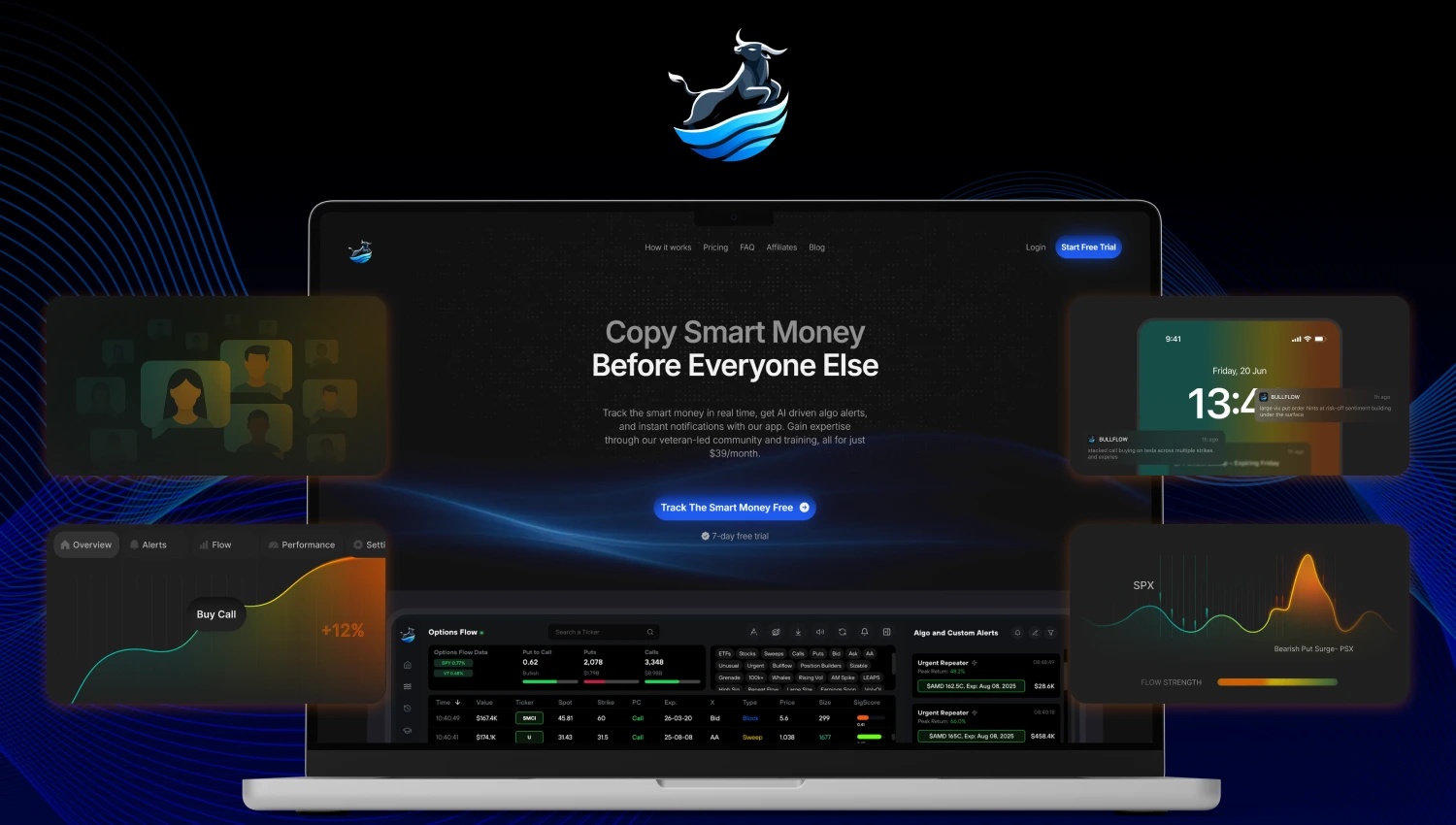

Bullflow.io is a real-time options flow and market data platform that helps traders track institutional activity, unusual options trades, and sentiment to uncover high-probability trading opportunities.

FoxRunner is a real-time stock market news aggregator and scanner designed to help traders stay ahead.

Bookmap is a real-time trading platform that visualizes market liquidity and order flow for smarter trading decisions.

AI-powered research assistant for investors—analyze companies, track data, and surface insights instantly.

No spam. Unsubscribe anytime. Used by professionals worldwide.

We track the best discounts on scanners, screeners, and research tools and email you when they're worth checking out.

No spam. Unsubscribe anytime.