Get 40% off Market Dash Elite with our exclusive link - no code needed. Works on the annual elite plan is the best offer available.

MarketDash is a modern stock research and analysis platform built for investors who want both simplicity and depth. It delivers hand-curated stock picks, AI-powered company analysis, and institutional-grade data — all in one intuitive dashboard. From weekly opportunities to long-term wealth-building ideas, MarketDash helps traders and investors make smarter, data-backed decisions without getting lost in complexity.

Weekly Opportunities

Short- to medium-term stock picks designed to capitalize on recent market events, technical patterns, and momentum.

Long-Term Wealth Picks

Carefully selected companies with strong fundamentals and durable growth potential for multi-year investing.

Complete Research Reports

Each pick includes fundamental analysis, mid- to long-term strategy, and trading strategy breakdowns.

AI-Powered SWOT Analysis

Analyze any company’s strengths, weaknesses, opportunities, and threats using advanced AI modeling.

Intrinsic Value Calculator

Proprietary discounted cash flow (DCF) model that shows whether a stock is overvalued or undervalued in real time.

Expert Tracking

Follow hedge fund trades, insider activity, and Wall Street analyst ratings for a 360° market view.

Fundamental Analysis Tools

Review financial statements, valuation ratios, profitability metrics, and growth rates — all updated daily.

User-Friendly Design

Clean, modern layout that simplifies complex data and makes professional-grade analysis accessible to everyone.

Retail investors looking for curated, actionable stock ideas

Long-term investors who want to build wealth with strong fundamentals

Traders who use both technical and fundamental analysis to guide decisions

Comprehensive Yet Simple – Combines analyst-level data with a clean, intuitive interface.

Human + AI Curation – Merges algorithmic screening with expert research and strategic context.

All-in-One Platform – From DCF modeling to stock picks, everything is integrated into one seamless tool.

Sign up for a free MarketDash account.

Access weekly stock picks and explore full company analyses.

Use tools like SWOT Analysis and Intrinsic Value modeling to evaluate ideas.

Upgrade to unlock detailed reports, hedge fund data, and premium insights.

Combines curated stock ideas with deep analytics

Easy-to-use dashboard with professional-level data

Affordable pricing for the depth of insights provided

It blends human expertise and AI analysis to deliver both curated stock ideas and deep data tools.

New opportunities are published weekly, with additional long-term picks released periodically.

Yes—MarketDash provides full access to income statements, ratios, and trend analysis.

Absolutely—the platform is designed to be intuitive for new investors while still powerful for advanced users.

MarketDash aggregates data from institutional sources, public filings, and proprietary AI models.

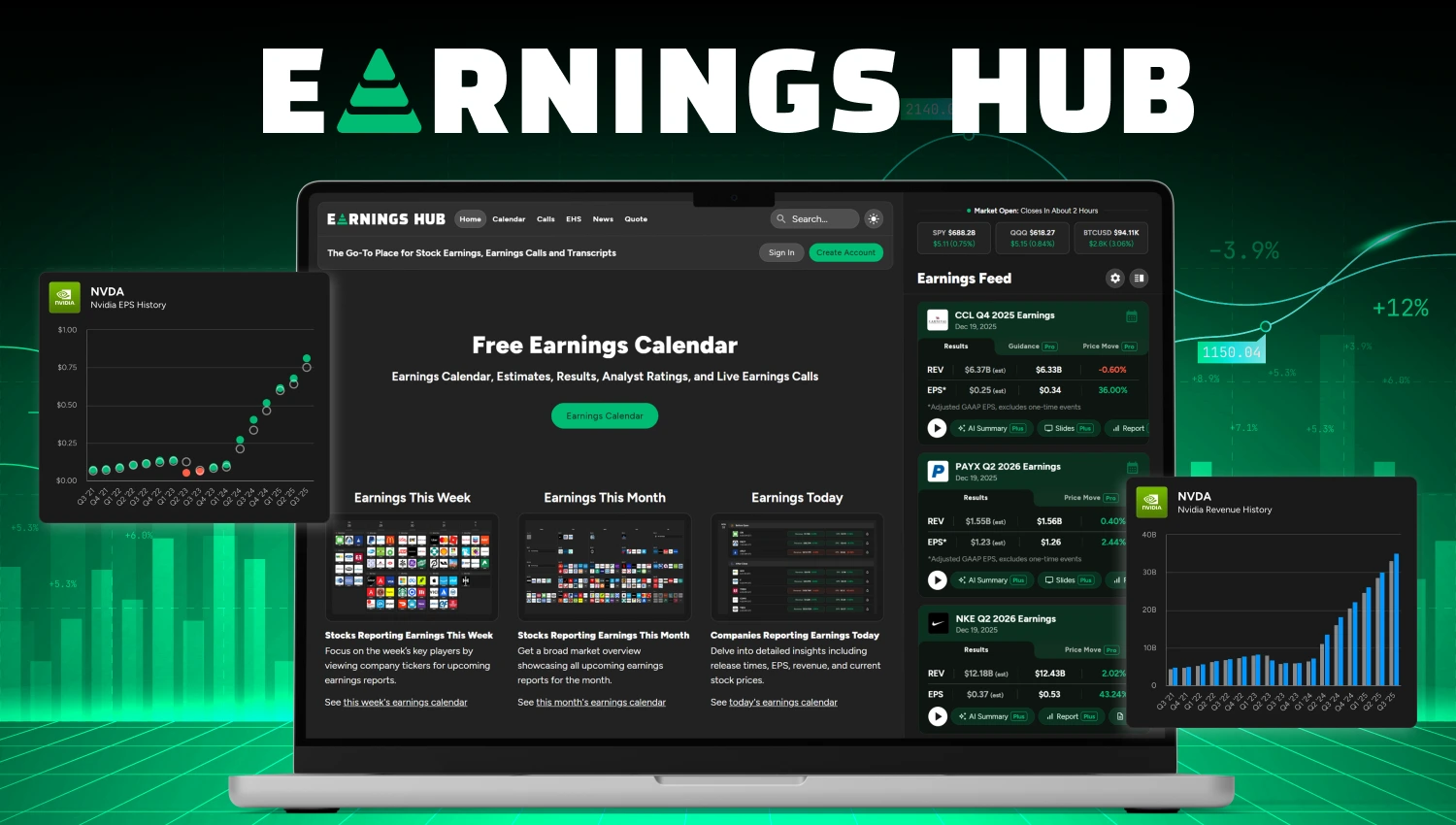

EarningsHub is a real-time earnings calendar and analysis platform built for traders who want to stay ahead of earnings season.

GuruFocus is a comprehensive investment research platform built for long-term, fundamentals-driven investors.

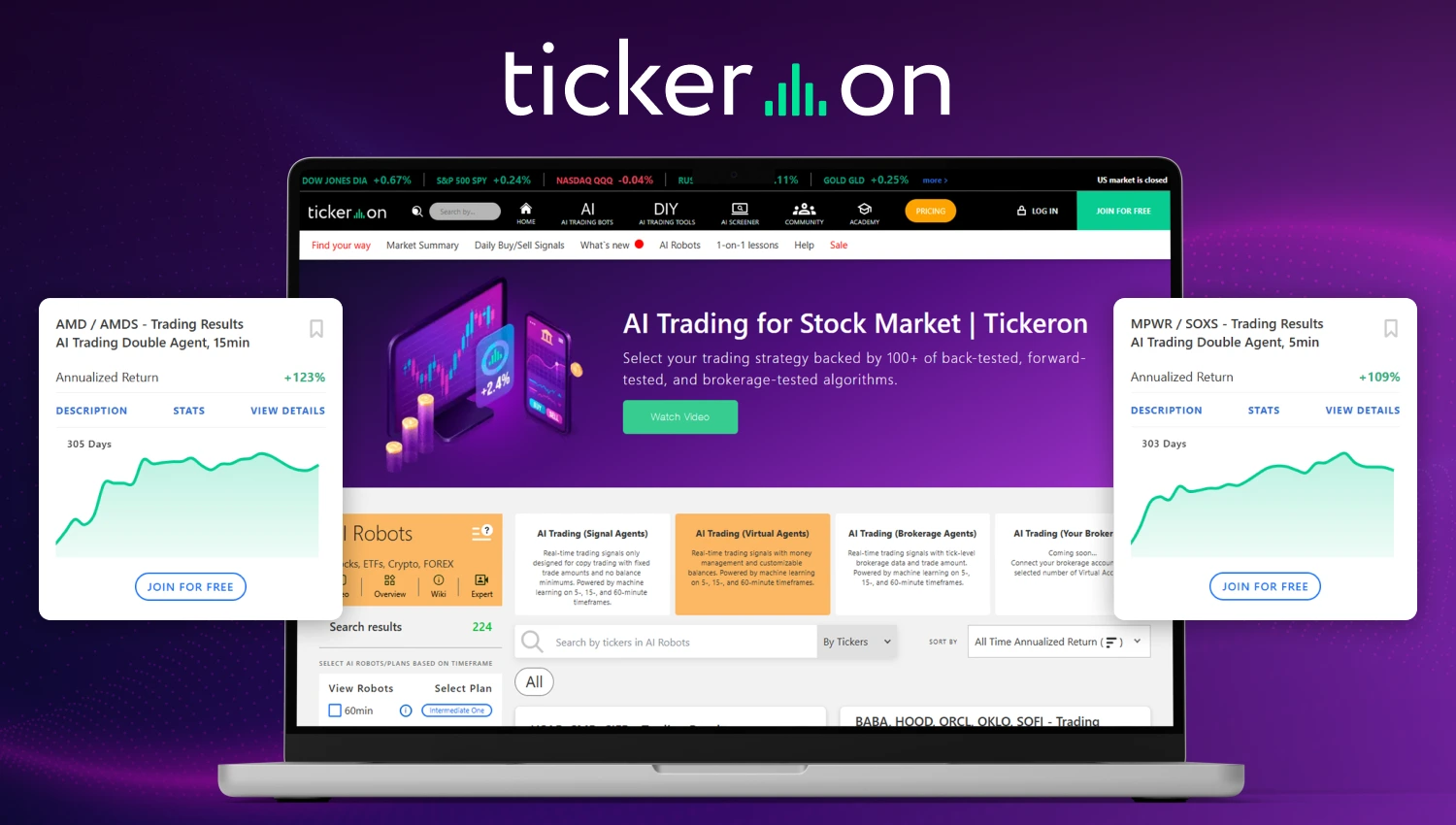

Tickeron is an AI-powered trading and investment platform that helps traders identify opportunities using predictive analytics, machine learning models, and pattern recognition.

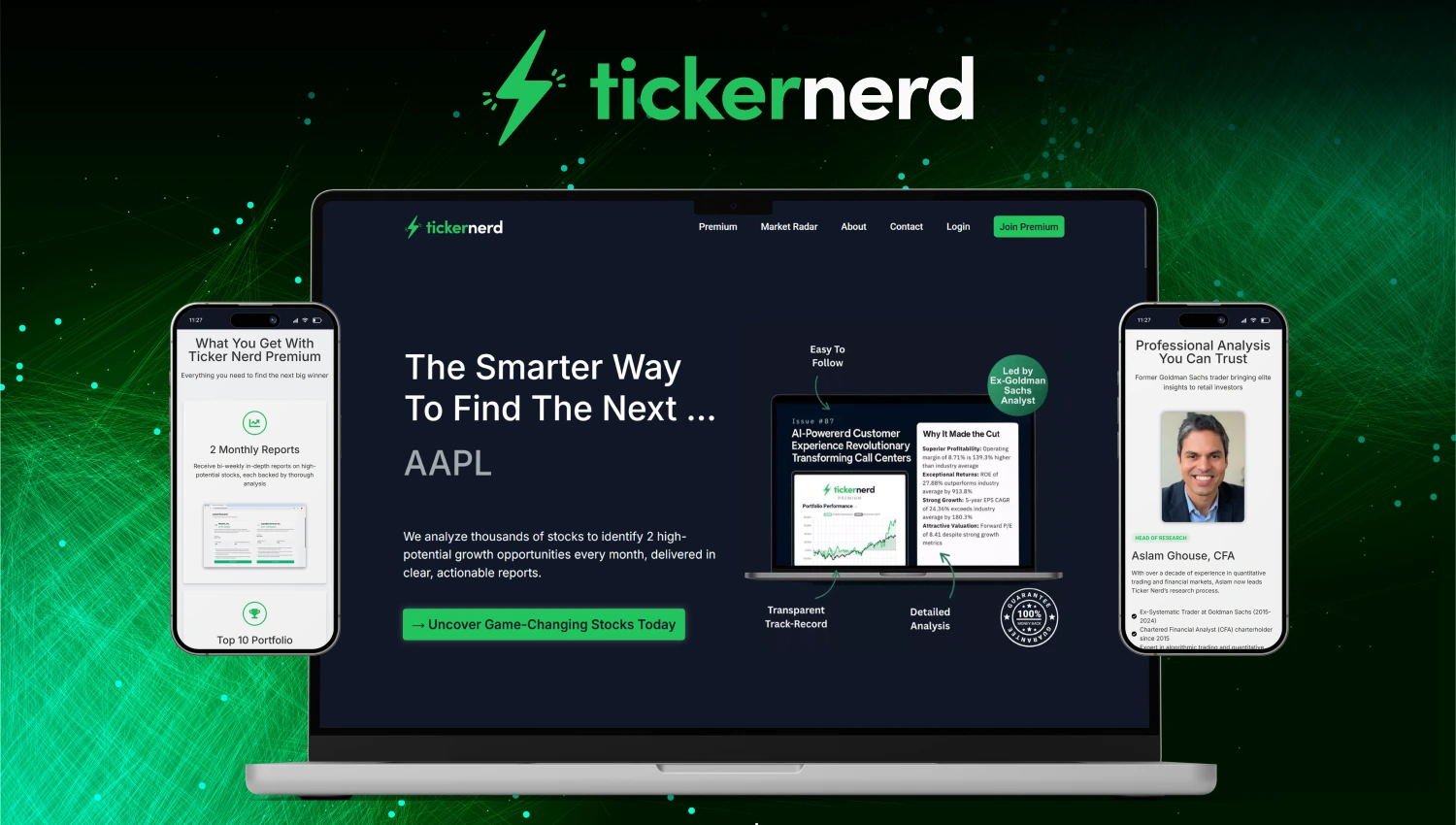

Ticker Nerd is a stock-picking newsletter that uses data from hedge funds, Wall Street analysts, and social sentiment—combined with fundamental and technical analysis—to deliver 1–2 high-conviction stock ideas to subscribers each month.

FinancialJuice is a real-time news and squawk platform built for active traders who need market-moving headlines as they hit.

Comprehensive financial terminal with real-time data, advanced charting, and institutional-grade research tools.

No spam. Unsubscribe anytime. Used by professionals worldwide.

We track the best discounts on scanners, screeners, and research tools and email you when they're worth checking out.

No spam. Unsubscribe anytime.