How I Used Trade Ideas and Ask EDGAR to Catch a 293% Winner in $BNAI

How I combined Trade Ideas and Ask Edgar to catch a 293% overnight momentum winner in $BNAI.

e0 and the Making of base.report

An in-depth founder interview of e0 exploring base.report and its approach to structured market prep for swing traders.

The Best Trading Podcasts Every Trader Should Listen To

Discover the best trading podcasts featuring real traders sharing their stories, strategies, and lessons learned. Bookmark this master list and listen at your own pace.

The Hardest Part of Trading Isn’t the Strategy

Traders don’t fail because their strategy is bad. They fail because they forget the goal. Here’s the hardest lesson I had to learn.

Why Is Schwab (thinkorswim) Restricting the Buying of Stocks?

Schwab has aggressively begun restricting the buying of volatile small cap stocks for active traders leaving us with no choice but to move elsewhere.

I’m Getting Back to Tracking My Trading

It has come that time in which I have to get back to tracking my trading, and I am using TradeZella as a way to accomplish that!

How My Trading Is Changing in 2026

Momentum stopped working late in 2025. Here’s how my trading is changing in 2026, with a focus on real companies, strong balance sheets, and downside protection.

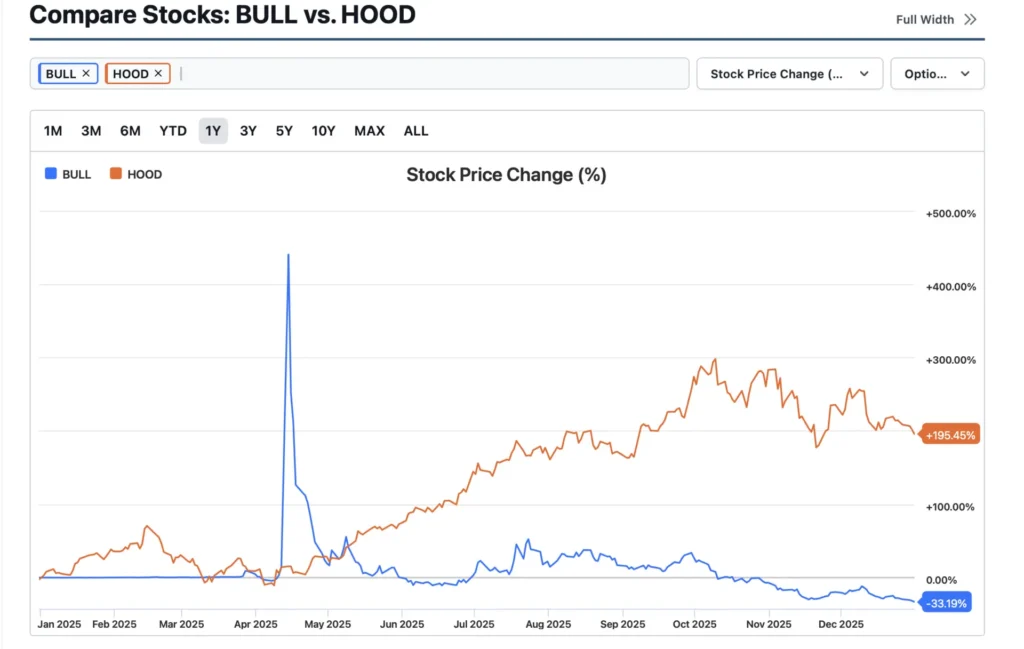

Why I Bought $BULL on the First Trading Day of 2026

Why I bought $BULL at $7.90 after a week of research, including valuation, cash balance, user growth, and asymmetric upside.

Dan Mirkin and the Making of Trade Ideas

An in-depth founder interview with Dan Mirkin on building Trade Ideas by solving his own trading problems with speed and real-time data.

Why I Bought The Trade Desk (TTD) Stock After a 69% Drop

The Trade Desk is down nearly 70% from its highs, but the business is still growing revenue, has a strong balance sheet, and serves many of the world’s largest advertisers. Here’s why I started a long position in TTD and how I’m thinking about the setup from a higher time frame perspective.