Get 20% off Dilutracker with our exclusive discount code below. Works site wide on your first billing cycle and is the best offer available.

Dilutracker is a specialized research platform built to help investors understand and manage stock dilution risk before it impacts their portfolio. By analyzing SEC filings, capital structure details, and funding needs, Dilutracker surfaces clear, actionable insights around dilution from warrants, convertible notes, secondary offerings, and shelf registrations—so investors aren’t caught off guard.

Dilution Risk Scores

Clear risk ratings for overall dilution, offering ability, cash need, and float risk.

Float Analysis

Understand the true trading float and how it compares to shares outstanding.

Cash Runway Tracking

See how many months of cash a company has before it may need to raise capital.

SEC Filing Analysis

Automated parsing of 10-Ks, 10-Qs, 8-Ks, S-1s, and shelf registrations.

Warrant Tracking

Identify outstanding warrants and strike prices before they dilute shareholders.

Convertible Note Monitoring

Track convertible debt that could convert into shares at any time.

Daily & Real-Time Alerts

Stay informed when new filings or dilution-related events occur.

Export & API Access

Download data or integrate dilution analytics into your own workflow (Pro plan).

Small-cap and micro-cap investors

Traders focused on dilution-sensitive setups

Long-term investors evaluating capital structure risk

Professionals who analyze SEC filings regularly

Dilution-Specific Focus – Built entirely around one of the most overlooked risks in investing.

Actionable Summaries – Turns dense SEC filings into clear, usable insights.

Preemptive Risk Management – Helps investors spot dilution before it hits the tape.

Search for a U.S.-listed stock or add it to your watchlist.

Review dilution risk scores, float data, and cash runway.

Monitor warrants, convertibles, and filing activity.

Receive alerts when dilution-related risks change.

Starter Plan

Full dilution reports, risk scores, up to 25 watchlist tickers, and daily email alerts.

Pro Plan

Everything in Starter plus unlimited watchlists, real-time filing alerts, data exports, and API access.

Highly focused on dilution risk

Saves hours of manual SEC filing review

Clear scoring system for fast decision-making

Cons

Limited use outside dilution-focused analysis

Covers U.S. stocks only

Ask Edgar – AI-powered SEC filing analysis for extracting key financial and risk insights.

Dilution Tracker – Dedicated platform focused on monitoring share dilution risk, warrants, and capital raises.

Dilutracker is an essential tool for investors who care about capital structure and downside risk. By translating complex SEC filings into clear dilution scores and alerts, it helps investors avoid being blindsided by share issuance and make more informed decisions.

Dilution occurs when a company issues new shares, reducing existing shareholders’ ownership percentage.

SEC filings including 10-Ks, 10-Qs, 8-Ks, S-1s, shelf registrations, and proxy statements.

Stock prices update in real time; SEC filings are processed within about 24 hours of publication.

U.S.-listed equities available through SEC EDGAR.

No—Dilutracker provides data and analytics for informational purposes only.

GuruFocus is a comprehensive investment research platform built for long-term, fundamentals-driven investors.

Portfolio123 is a professional-grade investment research, screening, and backtesting platform built for traders, portfolio managers, and data-driven investors.

MarketDash is a modern stock research and analysis platform built for investors who want both simplicity and depth.

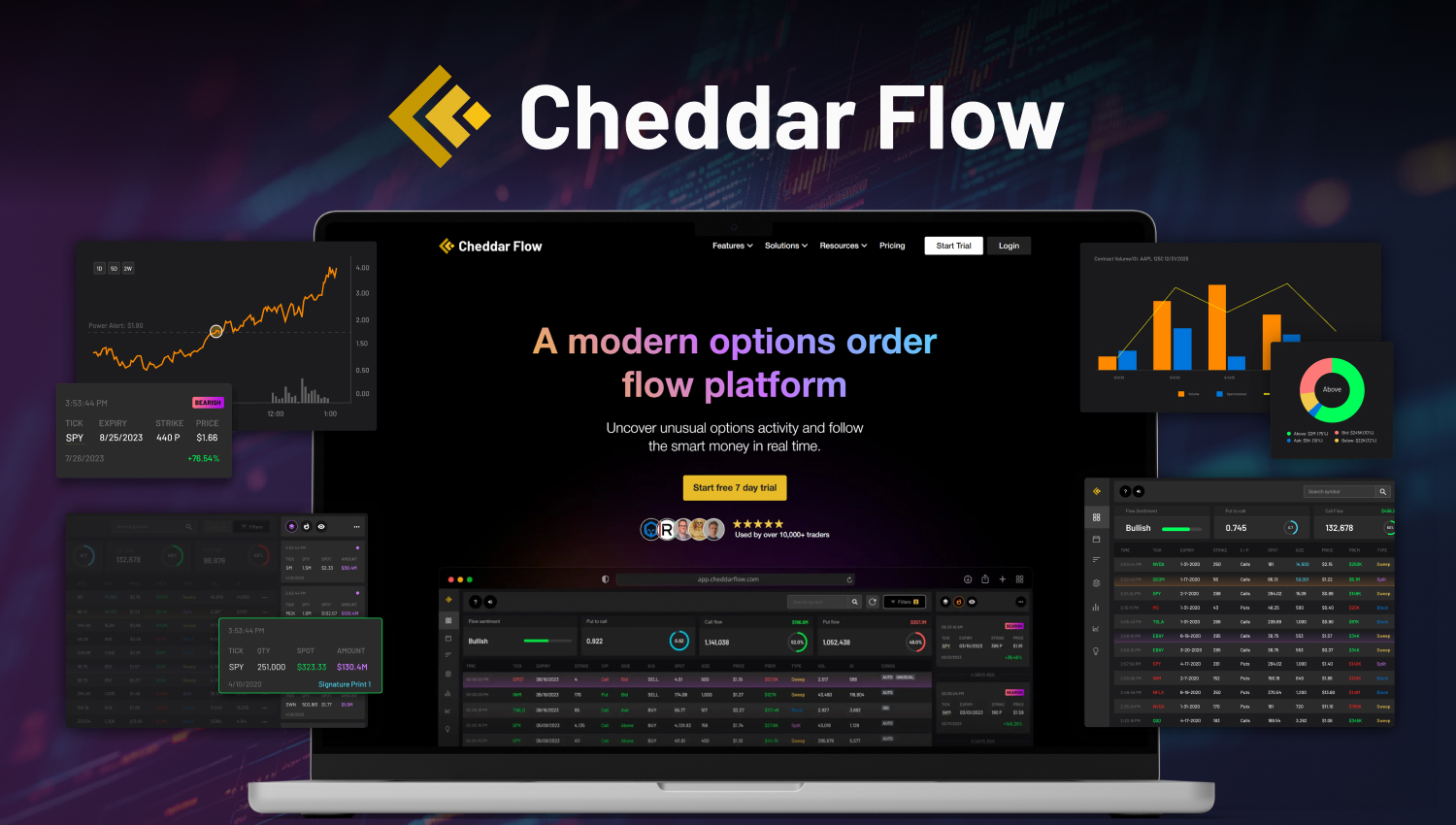

Track real-time options flow, unusual options activity, and dark pool prints with Cheddar Flow to follow institutional trades, uncover hidden market signals, and gain an edge in the options market.

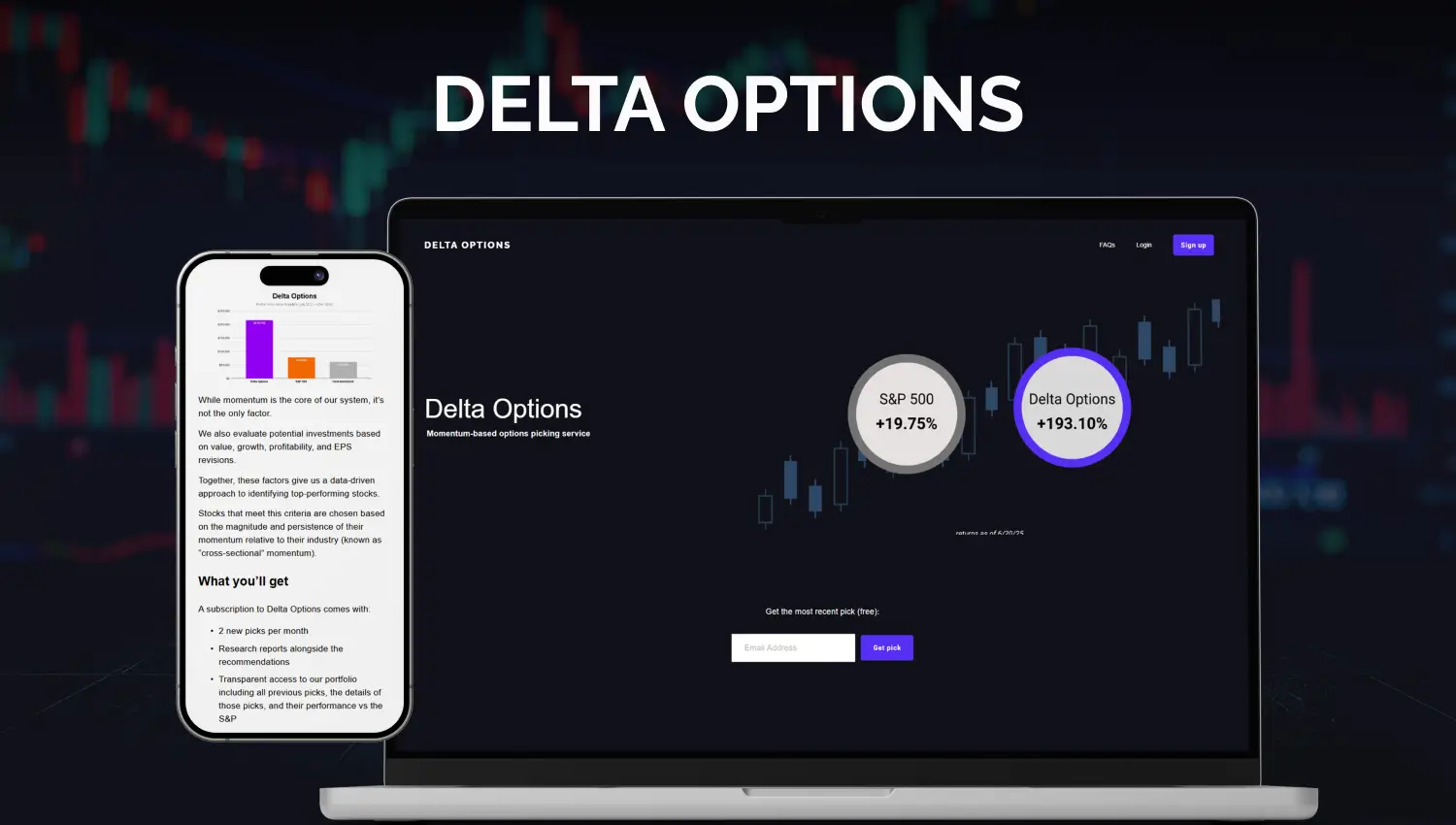

Delta Options is a momentum-driven options trading service delivering two high-conviction picks each month. Since launching in 2022, it has achieved nearly 250% returns with a transparent, data-backed strategy.

Professional trading community with real-time trade alerts and daily market recaps.

No spam. Unsubscribe anytime. Used by professionals worldwide.

We track the best discounts on scanners, screeners, and research tools and email you when they're worth checking out.

No spam. Unsubscribe anytime.