Editor’s Note:

This interview is part of our founder series on SaveOnTrading, where we interview the people behind the trading tools and services we personally use and recommend. The responses below are e0 words, lightly edited for clarity and length.

Who are you and what did you build?

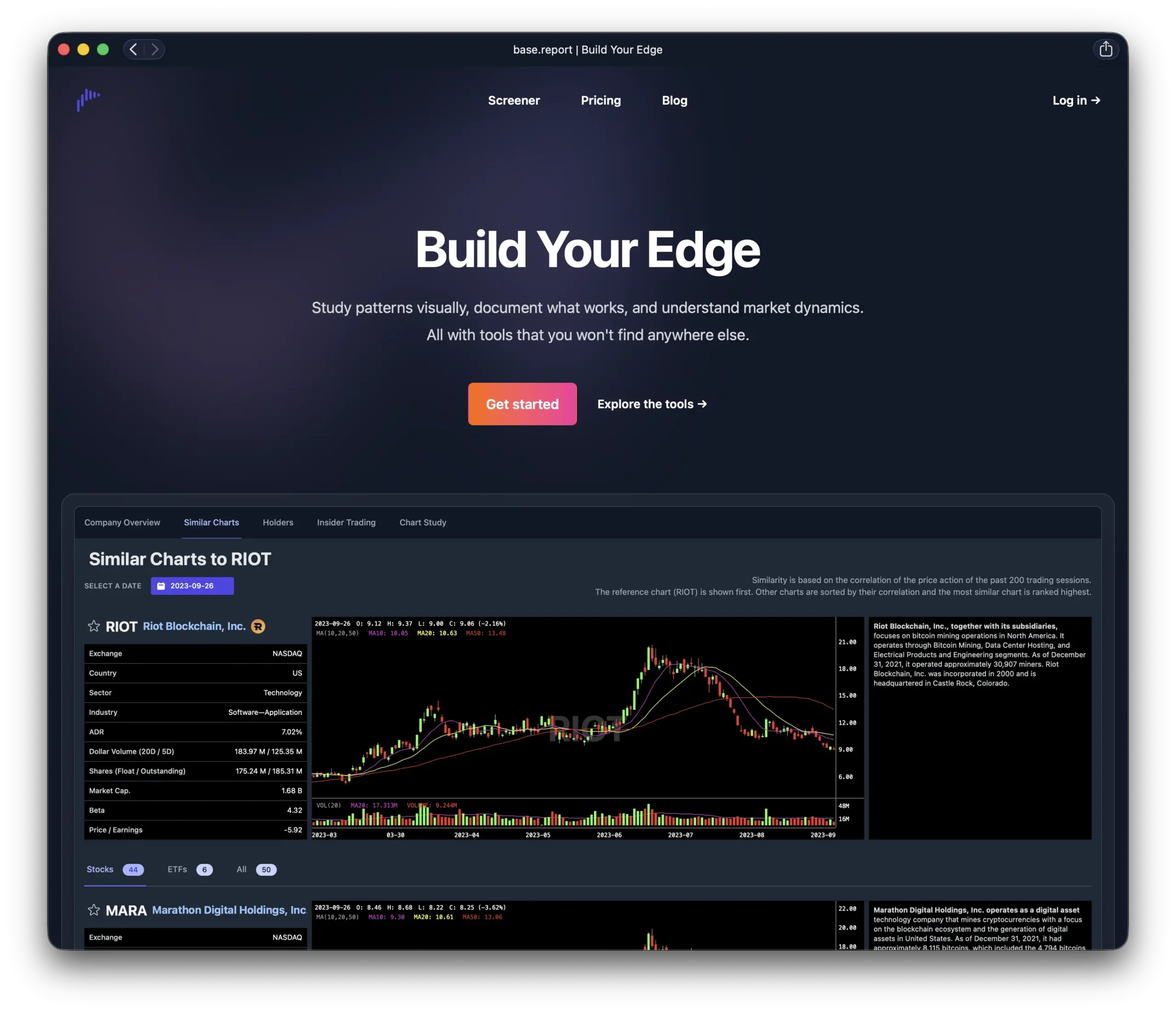

My name is e0, and I’m the creator of base.report, a market research platform primarily designed for swing traders who want to do high-quality market prep outside of market hours.

The goal from the beginning was to create a focused, efficient tool that combines technical and fundamental context in a way that actually reflects how traders prepare for the market.

I started building base.report very early in my trading journey. At first, it was simply a reaction to frustration. I liked parts of tools like MarketSmith, TradingView, and Finviz, but there was no single platform that gave me what I wanted in one place.

What problem were you trying to solve when you started?

I wanted a screener that focused on ADR (average daily range) percentage and dollar volume, with chart previews directly inside the scan results. I also wanted a modern version of MarketSmith’s stock overview page that combined the most useful technical and fundamental indicators without feeling dated or cluttered.

None of the existing tools really offered that combination. Most of them were also fairly expensive, usually in the $30 to $100 per month range. I wasn’t trying to build something massive. I just wanted a tool that fit my workflow and made market prep more efficient and enjoyable.

Why build your own tool instead of using existing ones?

Existing tools didn’t give me what I wanted in a single platform. I didn’t want to jump between multiple products just to do basic prep. That friction adds up quickly if you’re doing this every day.

So I started building something that solved my own pain points first. Over time, that turned into base.report.

How has base.report evolved since the early days?

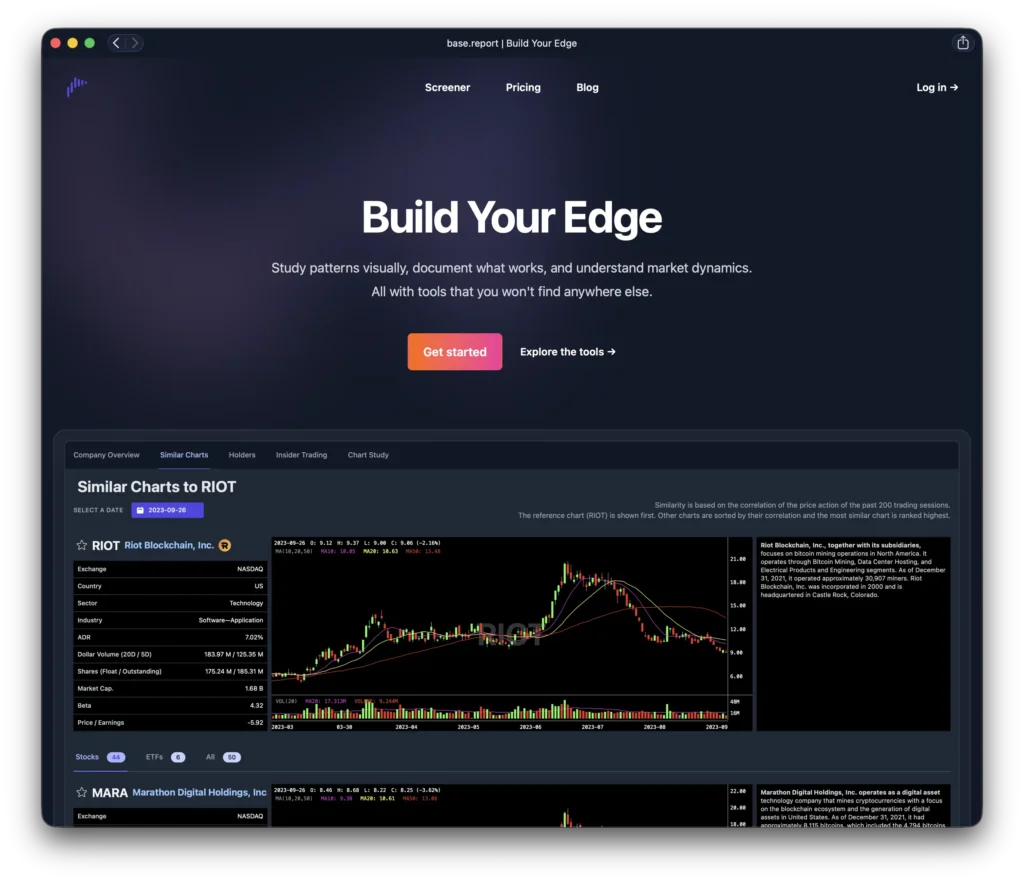

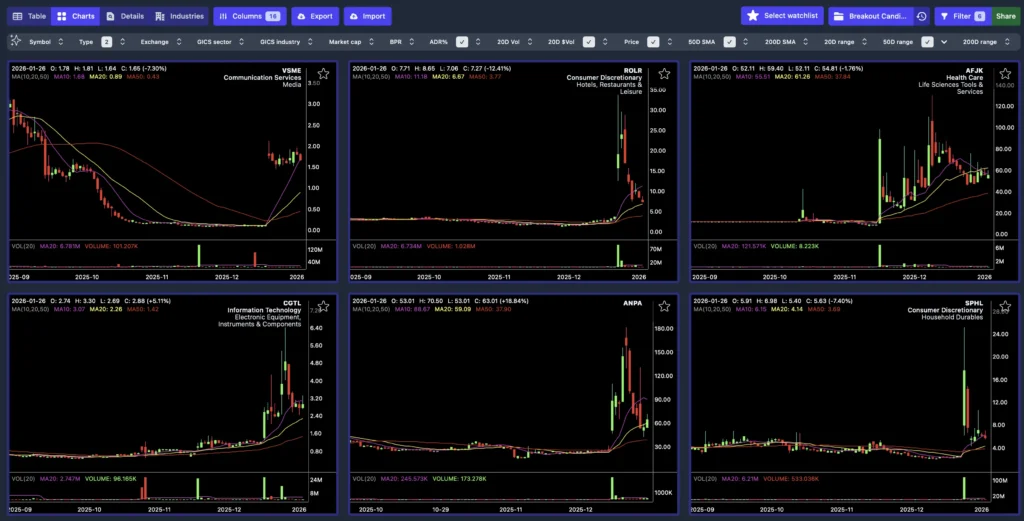

It started with just two core features: the screener and the stock page.

Screener Page:

Stock Page:

Since then, I’ve added several tools that have become central to the platform, including a stock theme builder and visualizer, a market overview and breakdown, and playbooks. I’m also constantly experimenting with features that don’t really exist anywhere else.

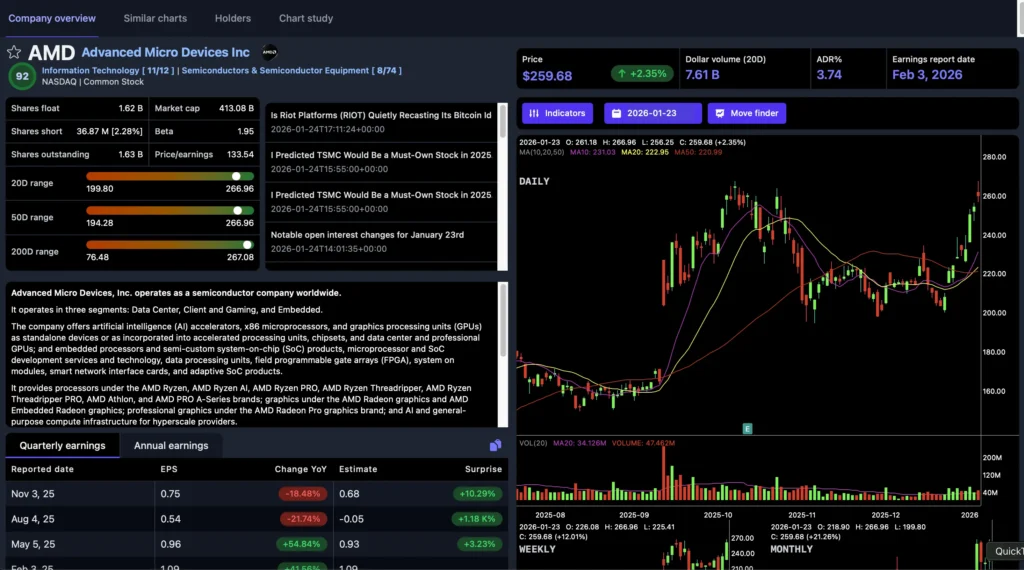

My favorite feature is the similarity scanner, or what I call the draw-to-scan tool. You can literally sketch a stock pattern, and the platform will scan for stocks that match that structure. That’s something I personally use all the time during prep.

Who is base.report best suited for?

The platform is built primarily for swing traders. That’s the core use case. That said, I’ve also heard from day traders and position traders who find it useful for planning and idea generation.

The intent is prep, not execution so if you are someone who preps before or after market hours for the following session, it might be a good fit for you.

Who is not a good fit for the product?

If you rely heavily on real-time intraday data, base.report probably isn’t the right tool. It doesn’t support scanning for setups such as episodic pivots because we don’t have live intraday data.

Anything that requires real-time alerts or constant updates is better handled by a different platform. Base.report is designed for thoughtful prep outside of market hours.

What is the biggest misconception people have about your product?

I’m not sure there really is one.

It’s not a huge or widely known tool, and it doesn’t have a massive user base. We do have a small Discord community, and I take user feedback seriously. If something feels unintuitive, I try to address it quickly. Because of that, I don’t think many misconceptions have had time to form.

What is your approach to trading?

I focus on swing trading, specifically targeting the strongest stocks within the hottest themes. This is the approach that I arrived at after a few years of trading.

At first, I was more focused on technical patterns. To be honest, although I heard phrases like “knowing a little bit of fundamental helps”, I had no idea what that meant. So in a way focusing on chart patterns was a cop-out, because it was easy to understand and make me feel like I was spending my time wisely.

Then as I learned more and more about trading, mostly from a handful of peoplel on Discord, I got better understanding of market dynamics and what type of fundamentals was important for me.

In short, it’s about keeping a tab on the more liquid stocks, grouping them into themes, and monitoring their relative strength. I agree with my buddy Dragonslayer that the most important thing boils down to stock selection.

What mistakes do traders often make when using tools like yours?

A common mistake is rushing to the end result. People try to find the perfect scan without doing the work required to properly evaluate what that scan is showing them.

Base.report is just a tool. Like any tool, how effective it is depends entirely on the user’s experience and effort. You can’t buy the best ingredients and expect to cook a Michelin-star meal without years of practice. The same logic applies here.

No tool will magically make someone a better trader without studying the market and putting in serious time.

How should users use base.report to get the most value?

We’ve never had better technology for learning tools than we do now with AI.

I suggest using a browser where an AI agent can read or interact with the site, and then asking something like, “My trading style is X. How should I use base.report to optimize my market prep?”

That kind of guided learning can dramatically shorten the learning curve.

Did you start this as a side project or full time?

It started as a side project and still is. You can think of it as an indie project.

I’m not a great marketer, but I genuinely enjoy building the tool and sharing it with a community that takes trading seriously.

How did you get your first users?

The first ten users likely came from the Qullamaggies Discord server. I learned most of what I know about trading there, and base.report wouldn’t exist without that community.

Beyond that, one of the biggest growth drivers was Kyna Kosling. She wrote a series of incredible blog posts about the platform, and her social shares brought in a lot of new users.

How did you think about pricing?

I wanted pricing to be a no-brainer, even for newer traders.

I also intentionally avoided long-term contracts or lock-ins. Trading already has a low success rate, and I really dislike seeing tools exploit people’s desire to improve their financial situation.

I wanted something that’s easy to try, easy to pause, and easy to leave.

Who do you see as your main competitors?

There isn’t really another tool that offers some of the core features we have, like the theme builder and similarity scanner.

That said, Finviz is probably the closest comparison. It’s a great tool and offers things we don’t, like Futures and Forex data. But if your focus is trading U.S. stocks or ETFs, I believe base.report offers a more efficient and enjoyable prep experience.

What has been the hardest part of building the business?

Marketing, without question.

I tried advertising a few years ago, but it didn’t feel cost-effective given my goal of keeping prices low. I also didn’t enjoy the process. I’d rather spend my time building the product and working with users who care deeply about trading.

I’m comfortable with growing organically as a small indie project.

Is the company bootstrapped?

Yes, completely bootstrapped. That gives me full creative control and avoids external pressure.

The biggest ongoing cost is market data, which makes up about 80 percent of expenses. Beyond that, it’s servers and essential services.

The largest cost overall is opportunity cost. I’ve spent thousands of hours working on base.report instead of freelance development, which is my primary income source.

What is your background?

I’ve worked professionally as a web developer since 2012 and started my own freelancing business in 2017.

Before that, I was very interested in product design. I’ve always enjoyed thinking about how things could be better, and I think that instinct has helped me build something that feels intuitive and well-designed.

What advice would you give someone building a trading product today?

I generally don’t love giving advice, because it’s often too rooted in personal experience. But my process usually looks like this:

First, identify a real pain point.

Second, explore existing tools to see if something already solves it well.

If nothing does, start building.

With AI today, it’s never been easier to prototype and iterate quickly.

What’s next for base.report?

I’d really like to finish the Time Travel feature. It would allow users to go back to a specific historical date and scan the market as if they were trading at that time.

Beyond that, I don’t love planning too far ahead. Hopefully, we’re still up and running and serving traders who care deeply about process and preparation.

A Note From SaveOnTrading

Base.report has earned strong word-of-mouth among experienced traders, particularly within the Qullamaggie Discord community where process-driven market prep is taken seriously. For traders who spend time outside market hours building themes, studying market structure, and refining ideas, base.report fits naturally into that workflow. If that sounds like how you approach the market, it’s worth exploring the platform below.