I saw a lot of progress in my appearance in 2025 as a result of tracking just three things:

- Calories in

- Calories out

- Protein

That was it.

Trading is no different.

When I track a small number of things, I perform well. When I don’t, I slowly start to slip up. One mistake turns into another, often without fully realizing how detrimental they can become over time.

The nice thing is that tracking your trading is simple nowadays. You really have two options:

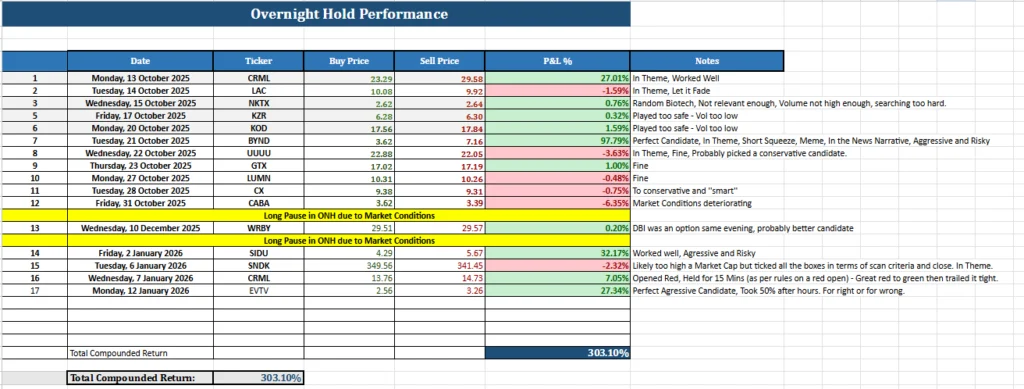

- Build your own spreadsheet, like the Irish Born Investor has, and track everything manually

(click to enlarge)

- Use a plug-and-play trading journal that links directly to your broker

Some of the more common options are:

Just going off the number of sales and clicks to the journals we offer, TradeZella sits clearly at number one. People consistently click into our exclusive TradeZella offer and end up purchasing it more than the others.

To me, there are only a few things you should track. Try not to overwhelm yourself, or the data won’t be meaningful and you’ll eventually stop altogether.

Start with:

- Date of the trade

- Ticker

- Entry price

- Exit price

- P&L %

- Setup

- Notes

That’s it.

Months down the road, you can always get more specific if you’d like, but you need to start somewhere. The goal isn’t to capture everything. It’s just to stay consistent.

Here’s to everyone getting back to tracking their trading going forward. I’m restarting this process myself, and I’m using TradeZella as a way to carefully track my trading again.