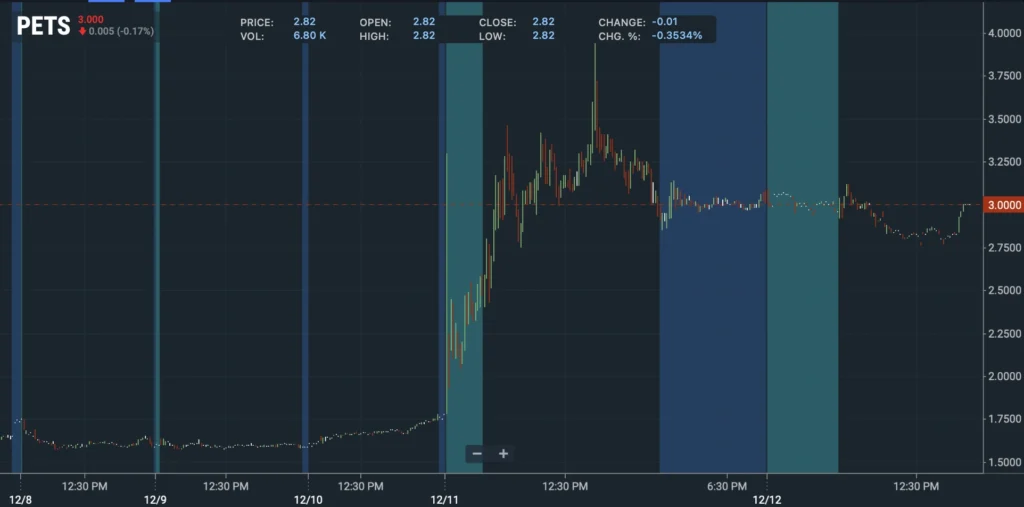

$PETS is a bigger-picture trade that I put on as of yesterday. I now have an average price of $3.02.

The reason I bought it is pretty straightforward.

$PETS was trading up yesterday, December 11th, 2025, on news that SilverCape Investments sent a non-binding proposal to acquire the company for $4 per share in cash.

This buyout proposal would give the company a market cap (shares outstanding × buyout price) of $84M.

But $PETS is a cash-rich company with roughly $54M in cash.

So if SilverCape were to buy $PETS, they would really only be buying it for about $30M (buyout price market cap – cash).

This is simply too cheap in my view, and it’s likely the company isn’t interested, as it is probably worth more to them than $30M.

$PETS has annual revenue of $226M and gross profit of $69M, though the company is currently losing about $6M per year. There’s no denying the business needs a turnaround as it has been drifting lower, but they have the cash to do so.

When you have a long runway of cash and little debt, you have optionality.

The move up on the potential buyout is what got the name on my radar, but the amount of cash this company has is pretty incredible.

The reasons I am long right now:

- If the buyout goes through (unlikely), I’ll make about a buck per share.

- Potential for the company to say no to the non-binding offer and for the stock to trade well above $4.00 – based on cash runway, potential turn around, and them saying they are “looking for more”.

- The cash gives them the ability to buy back stock, pay a special dividend, reinvest in the business to turn things around, and gives them time to figure things out in this new era.

- Their site receives a little over 1 million visits per month.

- More people are moving online for pet health products (prescription and over-the-counter meds, food, supplements, and supplies).

- Very high TrustPilot reviews

Anyways, I am long $PETS with an average price of $3.02 and trying to see it through. This is not financial advice, just me sharing a bigger-picture idea that I recently put on.

*The software used to read about $PETS both from a company perspective and a financial point of view was with StockAnalysis.com. You can use our discount code SAVEONTRADING for 10% off or just follow the link here.