Get 25% off your first month at Bullflow.io with our exclusive discount below! Works on the monthly plan and is the best offer available.

BullFlow.io is a real-time options flow and market data platform designed to help traders uncover institutional activity, unusual options trades, and market sentiment. Built for speed and clarity, BullFlow delivers smart data visualization and filtering tools so traders can identify where big money is positioning—across equities, ETFs, and indices.

Real-Time Options Flow

Monitor large block and sweep trades the moment they hit the tape.

Unusual Options Activity

Spot high-volume or out-of-the-money contracts that may signal major moves.

Smart Flow Filters

Customize filters by ticker, sector, expiration, or premium to focus on what matters most.

Dark Pool Tracking

See off-exchange trades that can reveal hidden accumulation or distribution.

Flow Visualization Dashboard

Clean, color-coded displays of bullish vs. bearish flow sentiment.

Alerts & Notifications

Get instant alerts when specific flow conditions or contracts appear.

Historical Data & Analytics

Review past flow trends and study how institutions positioned before big moves.

Multi-Asset Coverage

Data across stocks, ETFs, and indices for a full market view.

Community & Education

Access resources and flow education to improve interpretation and trading setups.

Options traders tracking smart money activity and institutional flow

Day and swing traders seeking catalysts through unusual trades

Market analysts who use options data to anticipate direction and sentiment

Fast, Reliable Data – Options flow and dark pool prints update instantly.

Clean Visual Layout – Intuitive dashboards make it easy to read and interpret complex data.

Affordable Institutional Insight – Access flow analytics typically reserved for professional desks.

Sign up and log in to BullFlow.io.

Choose your dashboard or flow filter setup.

Monitor real-time options activity and dark pool prints.

Use flow sentiment and alerts to time trades and manage risk.

Real-time unusual options and dark pool data

Clean, customizable dashboards

Affordable access to institutional-level analytics

Options order flow, unusual activity, and dark pool prints across US stocks, ETFs, and indices.

Yes—real-time data is available on Pro and Elite plans.

Yes—set alerts for tickers, trade sizes, or sentiment conditions.

Yes—BullFlow stores flow history for backtesting and research.

Yes—while focused on options flow, it provides data on underlying equities and sectors.

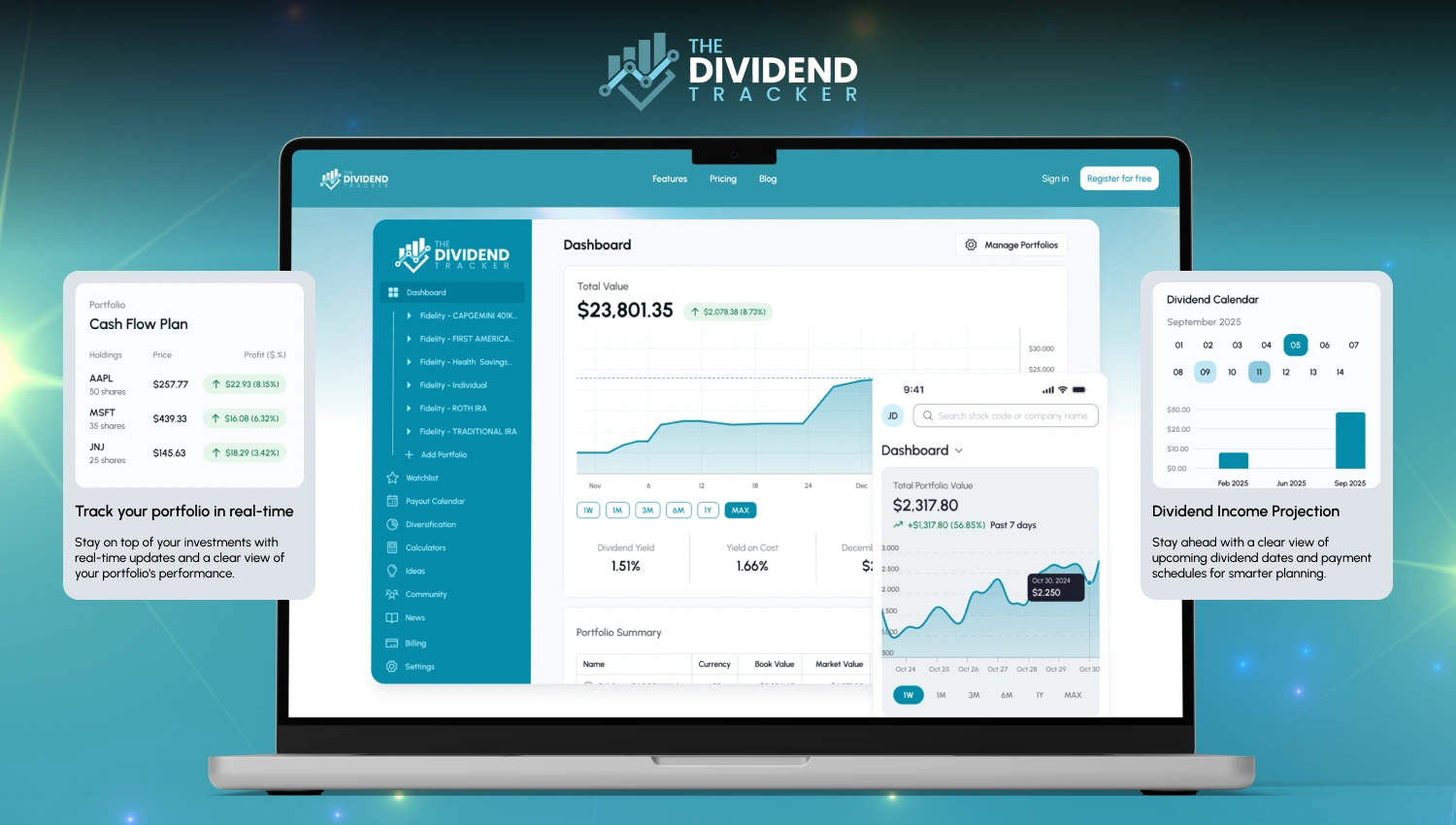

The Dividend Tracker is a portfolio management platform built specifically for dividend investors who want to monitor income, plan cash flow, and track long-term progress with clarity.

Edgeful is your personal financial analyst, simplifying market data into actionable reports. Instantly see how any stock behaves.

Professional trading community with real-time trade alerts and daily market recaps.

AI-powered research assistant for investors—analyze companies, track data, and surface insights instantly.

AI-powered SEC filings assistant that helps you extract meaningful insights quickly.

No spam. Unsubscribe anytime. Used by professionals worldwide.

We track the best discounts on scanners, screeners, and research tools and email you when they're worth checking out.

No spam. Unsubscribe anytime.